It would be easy to wonder if tech giant Microsoft (NASDAQ:MSFT) is having a bit of buyer’s remorse for its long-sought and hard-fought Activision Blizzard acquisition. Indeed, troubles stemming from Activision prompted a fractional drop in Microsoft’s stock price in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first problem kicked off when Activision Blizzard agreed to pay $54 million to settle a lawsuit against the company from before the Microsoft acquisition. The lawsuit, between Activision Blizzard and the California Civil Rights Department, alleged not only gender discrimination but also issues of pay equity and “…a culture of sexual harassment…” within Activision Blizzard.

A hefty $46 million will go directly to the workers in question, mostly women, who were either employees or contractors over a five-year span. The rest, meanwhile, will go toward “…implementing measures to ensure fair pay and equitable promotions.”

Activision Blizzard to Implement a Return-to-Office Mandate

Naturally, that $54 million is going to have to come from somewhere, and it looks like the plan to raise cash will come from a lot of firings. But it won’t come from outright firings. Instead, Activision Blizzard has a plan in the form of an increasingly familiar phenomenon: the return-to-office mandate.

Up until November 30, Activision was allowing the use of hybrid work schedules in its quality assurance (QA) department. Now, starting in January, that’s back to a complete five-day workweek in the office. Those who would rather work from home are welcome to do so with a completely different company, and Activision is offering severance accordingly.

What is the Price Target for Microsoft in 2023?

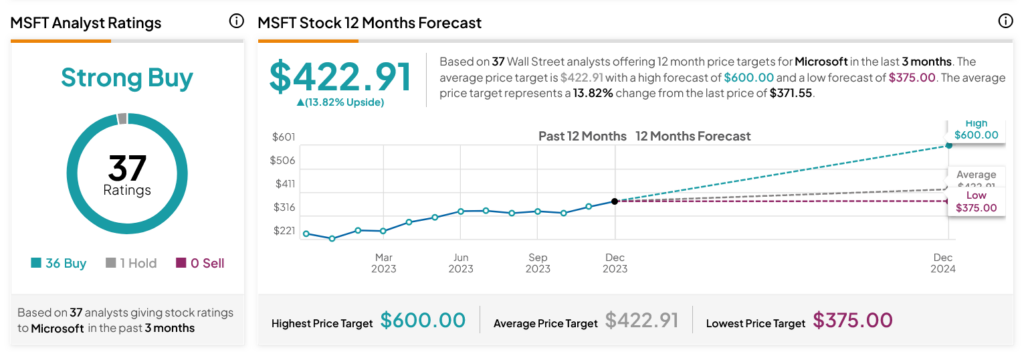

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 36 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 55.47% rally in its share price over the past year, the average MSFT price target of $422.91 per share implies 13.82% upside potential.