Global professional service provider Accenture Plc (ACN) reported outstanding first-quarter results, with both earnings and revenue beating estimates by a huge margin.

The expert in digital, cloud, and security was able to attract solid demand for its products and offerings during the quarter due to pandemic-driven digital transformation, and the company also increased its FY22 outlook. Following the news, shares soared 6.7% to close at $400.60 on December 16.

Outstanding Results

Accenture reported diluted earnings of $2.78 per share, up 20% compared to the prior-year period, and outpaced analysts’ estimates of $2.35 per share.

Furthermore, revenue rose 27% year-over-year to $14.97 billion, significantly surpassing analysts’ estimates of $12.56 billion. The growth was aided by Consulting revenue of $8.39 billion and Outsourcing revenue of $6.57 billion.

Moreover, new bookings increased 30% year-over-year to $16.8 billion, driven by Consulting bookings of $9.4 billion and Outsourcing bookings of $7.4 billion.

Rewarding Shareholders

Additionally, the company also announced a quarterly cash common dividend of $0.97 per share payable on February 15, 2022, to shareholders on record as of January 13, 2022. The dividend is 10% higher than the Dividend paid in the prior-year period.

As of November 30, Accenture had $5.6 billion remaining in its share buyback program.

Management Comments

Accenture’s Chair & CEO, Julie Sweet, said, “Our outstanding first-quarter financial performance and ability to capitalize on the market opportunity reflects continued market share gains. This is the direct result of having executed for years a strategy to rotate our business to digital, cloud, and security, both hiring and upskilling exceptionally talented people across the globe and fostering deep relationships with both the world’s leading companies and our technology partners.”

Guidance

Based on the continued business momentum, Accenture forecasts second-quarter revenue to be between $14.30 billion and $14.75 billion, significantly higher than the consensus estimate of $12.5 billion.

For the full year fiscal 2022, Accenture projects diluted earnings to be between $10.32 per share and $10.60 per share, compared to the consensus estimate of $9.01 per share. Meanwhile, FY22 revenue is expected to grow by 19% to 22% over FY21 revenue.

Analysts’ View

Responding to Accenture’s strong quarterly performance, Wedbush analyst Moshe Katri lifted the price target on the stock to $450 (12.3% upside potential) from $350, and maintained a Buy rating.

Katri is bullish about the tech sector on the whole, and believes that the digital transformation will continue to benefit the companies.

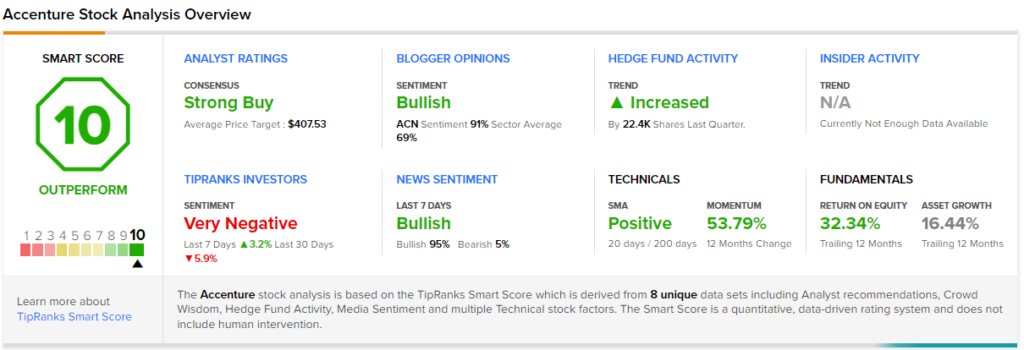

With 12 Buys and 3 Holds, the stock commands a Strong Buy consensus rating. The average Accenture price target of $407.53 implies 1.7% upside potential to current levels. Shares have gained 51.5% over the past year.

Smart Score

According to the TipRanks’ Smart Score rating system, Accenture scores a “Perfect 10”, which indicates that the stock has strong potential to outperform market expectations.

Related News:

Eli Lilly Impresses at Investment Community Meeting

Roblox Releases Poor November Metrics; Shares Plunge 9%

Lowe’s 2022 Guidance Misses Estimates; Shares Up 2%