Academy Sports and Outdoors announced that it is offering to sell 12 million shares of its common stock at $21.50 per share. Shares dropped 4.6% to $21.07 on Jan. 28.

Proceeds from the secondary offering, which is expected to close on Feb. 1, will only be received by selling stockholders. Academy Sports (ASO) is not selling any shares in its personal capacity.

In addition, the selling stockholders gave the underwriters a 30-day option for the purchase of up to an additional 1.8 million shares of Academy’s common stock. The offering comes after the stock spiked more than 43% over the past three months.

Founded in 1938 as a family business, Academy Sports has grown to 259 stores across 16 neighboring states across America. Its mission is to provide “Fun for All” sporting and outdoor recreational products at everyday low prices.

The company is involved in Environmental, Social and Governance (ESG) campaigns and in 2019 donated about $12.5 million that benefitted 625 different organizations and 265,000 individuals.

Academy recently announced the donation of $150,000 to St. Jude Children’s Research Hospital. Academy Chairman Ken Hicks said, “During these challenging times, it’s more important than ever to give back to an impactful organization like St. Jude Children’s Research Hospital.” (See Academy Sports stock analysis on TipRanks)

Loop Capital Markets analyst Daniel Adam initiated a Buy rating on ASO yesterday and set a Street-high price target at $30. This implies upside potential of around 42% from current levels.

The main drivers behind Adam’s bullish views include the strength of ASO’s balance sheet due to its recent debt paydown, a long-term secular trend shift towards health a fitness, and an accelerating e-commerce business.

From the rest of the Street, Academy receives a Strong Buy consensus rating based on 3 recent Buys. The average analyst price target of $27 suggests upside potential of around 28% over the next 12 months.

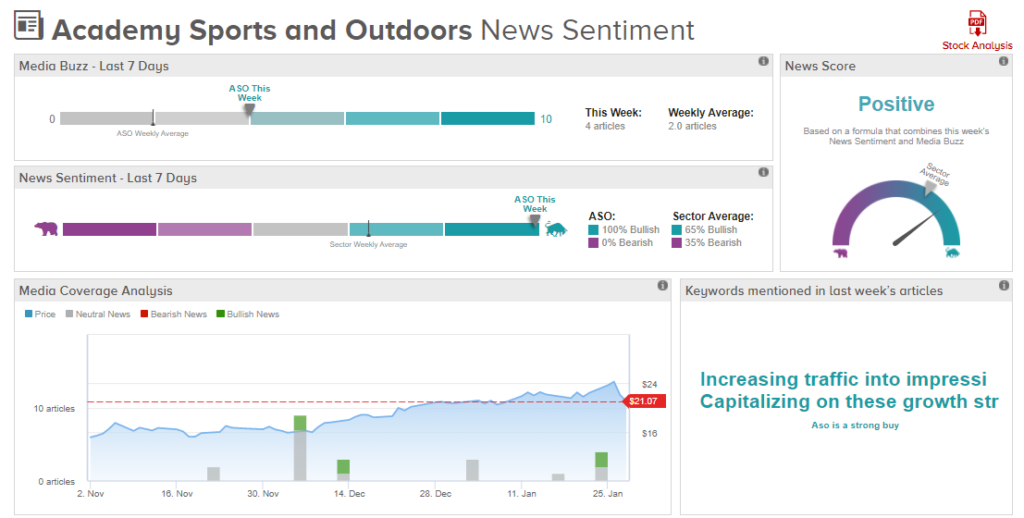

News Sentiment over the past seven days is Very Bullish with 100% of the articles published being positive compared to a 65% sector average.

Related News:

Comcast Posts Surprise 4Q Profit; Shares Gain 6.6%

Novavax’s COVID-19 Vaccine Is 89.3% Effective In UK Trial; Shares Pop 27%

First Majestic Silver Says It’s Unaware Of Reason For Share Gain