Shares of Acacia Communications soared 9.9% on Friday after the optical interconnect products maker terminated its merger deal with Cisco Systems.

Notably, the deal was announced in July 2019, wherein Cisco agreed to buy Acacia for $2.6 billion in cash.

Acacia (ACIA) cited lack of approval from the Chinese regulatory body as the reason for scrapping the deal. Acacia said that it didn’t received approval for the transaction from the Chinese government’s State Administration for Market Regulation before Jan. 8, 2021, a deadline fixed under the merger agreement.

However, later in the day, Bloomberg reported that Cisco (CSCO) has won a temporary court order that prevents Acacia from terminating the planned merger agreement between the two companies.

In a separate statement, Cisco announced that it has sought confirmation from the court that it has met all conditions for closing the transaction, including approval from the Chinese regulatory body. (See ACIA stock analysis on TipRanks)

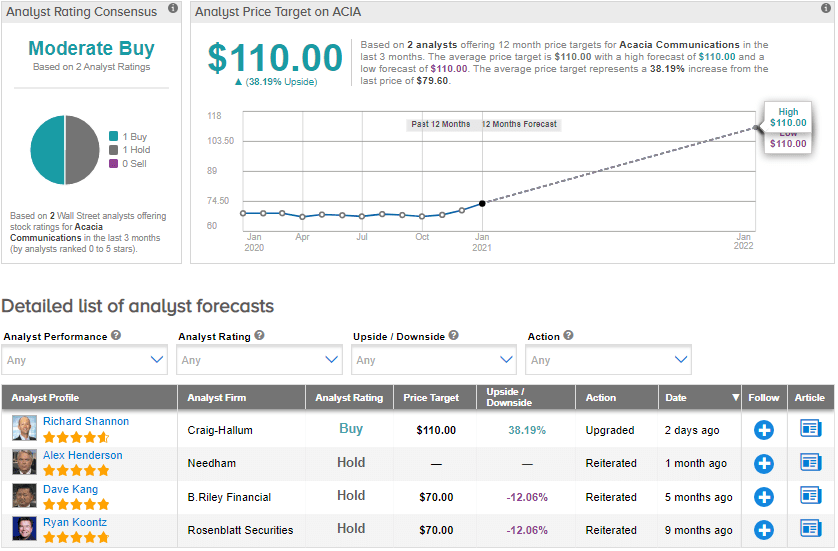

Following Acacia’s merger termination announcement, Craig-Hallum analyst Richard Shannon upgraded the stock to Buy from Hold and raised the price target to $110 (38.2% upside potential) from $70. Shannon believes that the company’s value is significantly higher than Cisco’s previous bid of $70 per share.

While Craig-Hallum remains bullish, Needham maintains a Hold rating. The average price target of $110 on Acacia implies upside potential of about 38.2% over the next 12 months. Shares have gained 16.4% over the past year.

Related News:

Wyndham Buys Travel + Leisure For $100M; Analyst Lifts PT

LafargeHolcim Inks $3.4B Deal To Buy Firestone Building; Shares Rise 4.6%

Walgreens To Sell Distribution Unit To AmerisourceBergen For $6.5B; Shares Gain