AbbVie reported 4Q diluted EPS of $2.92, which came in ahead of analysts’ estimates of $2.86. Revenues in the fourth quarter were up by 59.2% year-on-year to $13.8 billion versus analysts’ estimates of $13.7 billion. Shares of the pharma company rose 1.4% in US morning trading.

AbbVie’s (ABBV) CEO Richard A. Gonzalez said, “We successfully completed the transformative Allergan acquisition and delivered another year of strong results in 2020, despite the challenges presented by the global pandemic. Based on our broad portfolio of diversified growth assets and the robust momentum of our business, we expect impressive growth again in 2021.”

Revenues of the company’s immunology business portfolio increased by 15.3% year-on-year to $5.9 billion in 4Q while sales at its hematologic oncology business portfolio grew by 15.7% to $1.8 billion. (See AbbVie stock analysis on TipRanks)

The company provided FY21 diluted EPS guidance in the range of $6.69 to $6.89 and expects its adjusted diluted EPS to be in the range of $12.32 to $12.52.

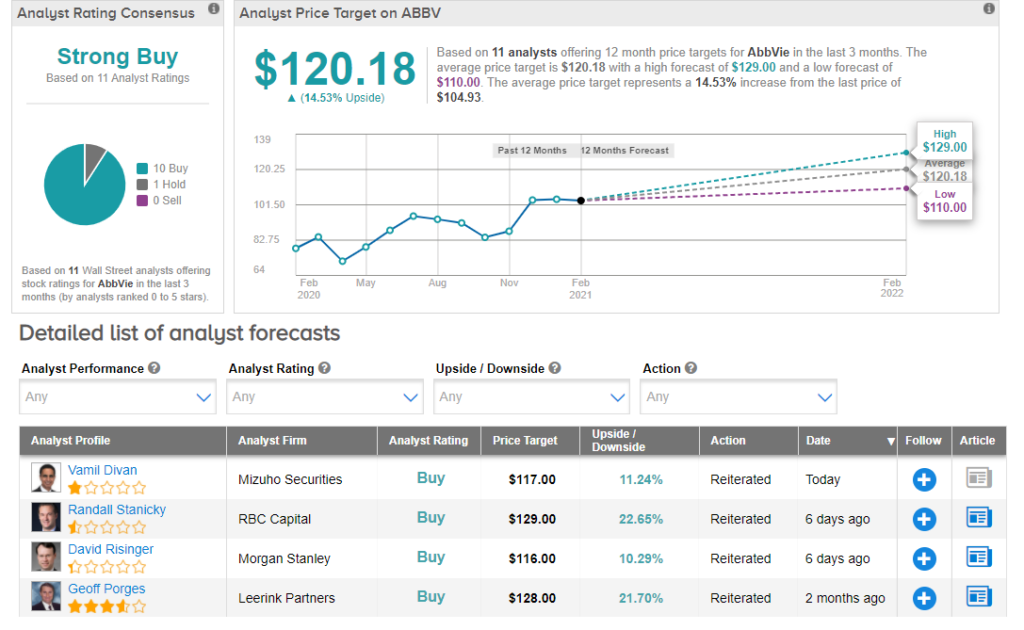

Following the fourth quarter results, Mizuho Securities analyst Vamil Divan reiterated a Buy rating and a price target of $117 on the stock. Divan wrote in a note to investors, “The beat was led by several important products, including Skyrizi, Rinvoq, Ubrelvy, Botox Cosmetic and Juvederm, and supported by other assets such as Linzess and Restasis.”

“Following their recent disclosure of long-term guidance through 2030, we believe AbbVie now represents an especially compelling investment opportunity, with robust near-term growth and good visibility into its long-term growth prospects, while still trading at a significant discount to its peers and offering a robust dividend.” the analyst added.

The rest of the Street has a bullish outlook on the stock with a Strong Buy consensus rating. That’s based on 10 analysts recommending a Buy versus just 1 analyst suggesting a Hold. The average analyst price target of $120.18 implies about 15% upside potential to current levels.

Related News:

Chevron and Exxon Discussed Possible Merger Last Year – Report

UPS Beats 4Q Revenue Estimates; Shares Jump 4.2%

Virgin Galactic Shares Pop 14% Pre-Market After Flight Test Program Update