Despite delivering impressive second-quarter results, Abbott Laboratories (ABT) shares were trading 1.7% lower at the time of writing this article. The company also raised its FY2022 earnings guidance well above analyst expectations.

ABT’s Q2 Beat

The company reported stellar quarterly earnings of $1.43 per share, which is significantly higher than analysts’ estimates of $1.14 per share and 22.2% higher than earnings reported in the prior-year period.

Similarly, revenue climbed 10.6% year-over-year to $11.3 billion, compared to the prior-year period and outpaced the Street’s estimate of $10.3 billion.

The outstanding revenue growth is attributed to higher organic sales growth of 14.3% as well as global COVID-19 testing-related sales of $2.3 billion during the second quarter.

Abbott Raises FY2022 Outlook

Based on robust Q2 results, management raised the financial guidance for FY2022. The company now forecasts adjusted earnings of at least $4.90 per share, while the consensus estimate is pegged at $4.88 per share.

ABT CEO’s Comments

Abbott CEO, Robert B. Ford, commented, “Our new product pipeline has remained highly productive, and our diversified business has continued to be resilient in a challenging macro environment.”

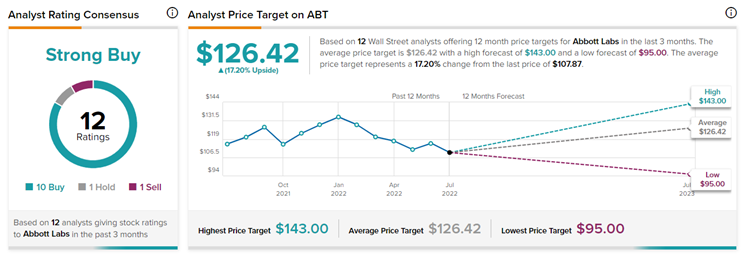

Wall Street Remains Bullish on Abbott

The Wall Street community remains optimistic about the stock with a Strong Buy consensus rating based on 10 Buys, one Hold and one Sell. The average Abbott price target of $126.42 implies upside potential of 17.20%.

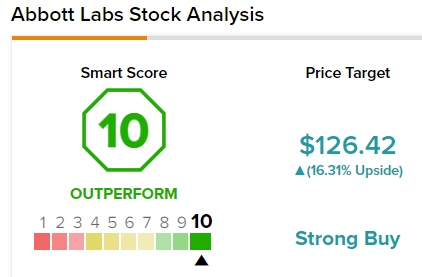

TipRanks’ Smart Score

ABT scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Conclusion

Recently, Abbott stock has been in the news for its baby formula controversy.

Positively, the Q2 beat implies that the negative impact from the Michigan plant shutdown was more than offset by the strength in diabetes products and COVID-19 tests.

Further, the continued strength of its new product approvals also bodes well for the stock.