Domino’s Pizza (DPZ) is a restaurant chain that operates a network of franchise-owned stores in the U.S. and internationally.

The corporation recently released its fourth-quarter results report for 2021, which saw its revenue fall 1% year-over-year to $1.34 billion. However, same-store sales in the United States increased by 1% from the year-ago quarter. In the meanwhile, adjusted profits per share were $4.25, up 22.8% on a year-over-year.

Also, the board of directors of Domino’s Pizza also approved a $1.10 per share quarterly dividend to be paid on March 30, 2022. The current dividend yield for the corporation is 0.95%.

Let’s look at the risk factors for Domino’s Pizza using the new TipRanks’ Risk Factors tool.

Risk Analysis

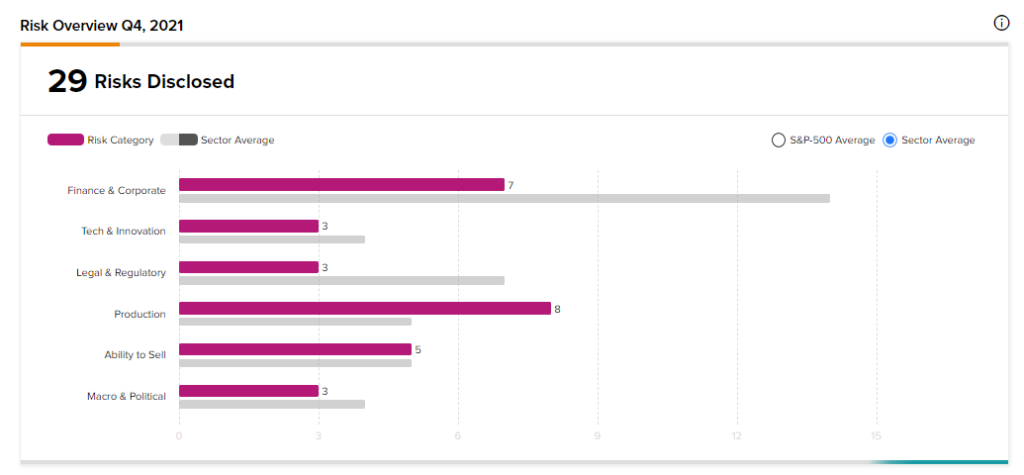

Domino’s Pizza’s main risk category is Production, which accounts for 8 risks of the total 29 risks identified. The next major Domino’s Pizza risk falls under the Finance & Corporate category, which accounts for 7 risks.

In its recent report, the organization has added one new risk under the Legal & Regulatory category. The company said, “Environmental, social and governance matters may impact our business and reputation.

Domino’s Pizza highlights that investors’ attention to environmental, social, and governance (ESG) practices has grown over time. There are also a number of groups that examine a company’s performance on ESG issues, and the findings of these assessments are publicly published. Further, in December 2021, the firm stated its intention to attain Science-Based Targets by 2035 and net-zero carbon emissions by 2050.

Domino’s Pizza warns investors that the company may not be able to achieve all of these goals due to risks and uncertainties, many of which are beyond the company’s control. Highlighted is that any failure to accomplish the aforementioned targets, as well as to manage ESG issues, might result in a slew of challenges, including damage to the firm’s reputation. It could also have a negative influence on its stock price and financial consequences, according to the corporation.

Wall Street’s Take

Turning to Wall Street, the stock has a Moderate Buy consensus rating, based on nine Buy, 14 Hold, and 1 Sell ratings. The average DPZ price target of $474.29 implies 19.4% upside potential from current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News :

Genmab & AbbVie Obtain Orphan Drug Designation for Epcoritamab in the U.S.

Amazon Reveals 20-for-1 Stock Split & $10B Share Buyback; Shares Jump

Google & Mandiant Combine for $5.4B to Enhance Cybersecurity