American Electric Power Company (AEP) is a public utility company. It generates and distributes electricity used by more than 5 million customers across 11 states.

For Q4 2021, AEP reported revenue of $4.1 billion, which increased from $3.6 billion in the same quarter the previous year and exceeded the consensus estimate of $3.7 billion. It posted adjusted EPS of $0.98, which jumped from $0.87 in the same quarter the previous year and beat the consensus estimate of $0.94.

The company plans to distribute a quarterly dividend of $0.78 per share on March 10. AEP stock currently offers a dividend yield of 3.59%, compared to the sector average of 2.9%.

With this in mind, we used TipRanks to take a look at the newly added risk factors for American Electric Power.

Risk Factors

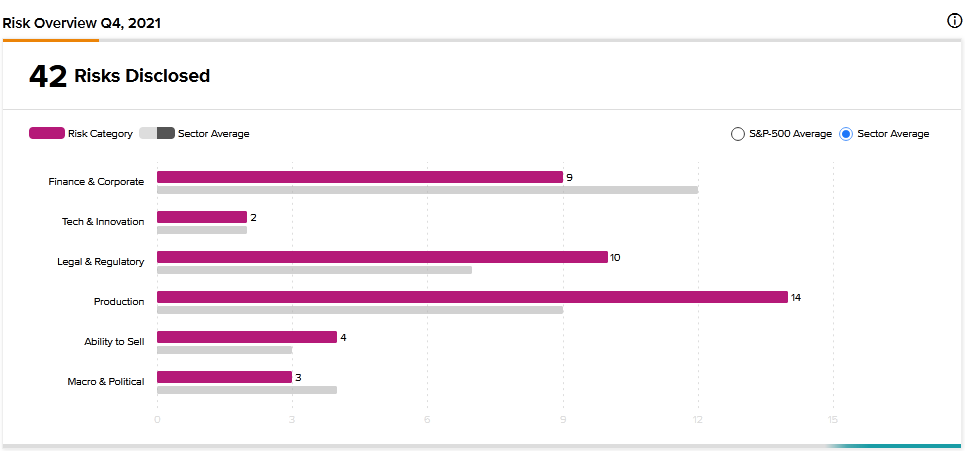

According to the new TipRanks Risk Factors tool, American Electric Power’s top risk category is Production, with 14 of the total 42 risks identified for the stock. Legal and Regulatory and Finance and Corporate are the next two major risk categories with 10 and 9 risks, respectively. The company has recently updated its profile with three new risk factors.

In a newly added Legal and Regulatory risk factor, American Electric Power informs investors that its business is heavily regulated. It mentions regulations related to labor, health and safety, and antitrust matters. The company explains that new regulations or changes to existing regulations may require it to undertake significant system and operational adjustments, which could require significant capital expenditures. Rising costs could adversely affect the attractiveness of the company’s products. Additionally, changes to regulations may result in adverse publicity and could damage the company’s reputation.

In another new Legal and Regulatory risk factor, American Electric Power discusses tax issues. It tells investors that the White House and Congress have proposed significant changes to the tax laws. The company warns that changes to tax laws could harm its operating results and financial condition.

Finally, the company informs investors in a newly added Production risk factor that global supply-chain disruptions threaten its operations and corporate strategy. It mentions disruptions to the delivery of equipment, components, and materials critical to its business operations. It cautions that the shortages could delay the construction and repairs necessary to support its regular operations. American Electric Power warns that the constraints could reduce its cash flow and harm its financial condition.

AEP stock has gained about 24% over the past 12 months.

Analysts’ Take

Evercore ISI analyst Durgesh Chopra recently reiterated a Buy rating on American Electric Power stock with a price target of $102, which implies 14.02% upside potential.

Consensus among analysts is a Strong Buy based on 7 Buys. The average American Electric Power price target of $100.14 implies 11.94% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Halt Production in Kansas City Due To Chip Shortage – Report

What Risks Does Chevron Face in this Oil-Demanding Environment?

Foot Locker Plumets 30% on Weak FY22 Outlook Despite Q4 Beat