Cash flow is the lifeblood of any stock or the company that’s behind it. Without cash flow, operations dry up, and soon enough, so does everything else. Thus, revenue streams are vital to the ongoing health of stocks as a whole. Just ask Amazon (NASDAQ:AMZN), who may have found a whole new potential revenue stream, and it’s not the only one, either. At any rate, Amazon is up nearly 1.5% on the revelation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon may be a major potential beneficiary of this new source of revenue, but it’s far from alone. Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is also in line to get in on this development, and it’s looking like quite a development indeed.

In fact, a report from Morgan Stanley analyst Brian Nowak notes that the market for this new concept—offering graphics processing units (GPUs) on an as-a-service basis—could represent over $44 billion. And that’s just for starters; by 2026, that number could increase to $60 billion. The notion of offering hardware on an as-a-service basis is already fairly widely used; we’ve seen cloud gaming operations take off, and given the sheer number of applications for GPUs, it’s no surprise to see it here.

And that’s not all Amazon’s got up its sleeve of late; iOS and web-based users will now be able to access Amazon through a passkey system instead of only a password. With a passkey system, users can use Touch ID, Face ID, or a PIN to get in on trusted devices.

Passkeys, thus, become more secure than passwords by linking them to devices and biometrics at the same time. Users can start enrolling for passkeys now, though users can continue to use passwords for the foreseeable future.

Is AMZN Stock a Good Buy Right Now?

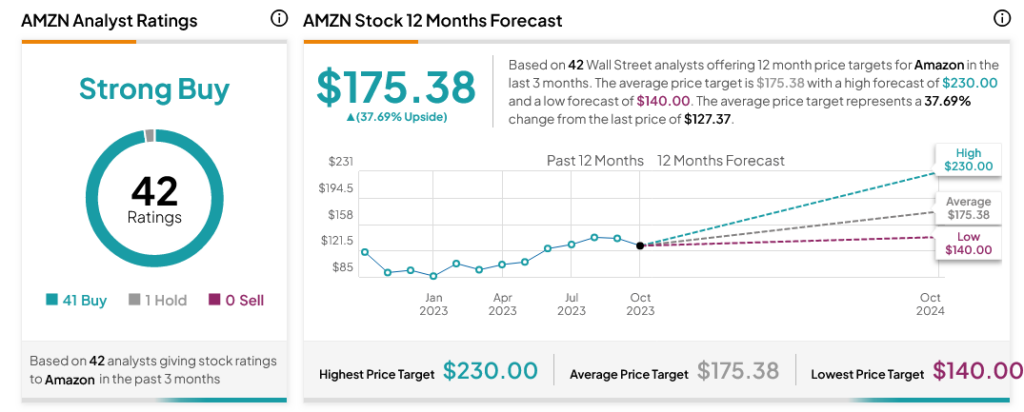

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 41 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $175.38 per share implies 37.69% upside potential.