Top stocks to snap up in March 2021, according to Wall Street analysts. Following post-election optimism and retail-driven rallies in heavily shorted and “meme” stocks, markets took a breather starting in mid-February. Many of the top-performing stocks of the past year (EV stocks, tech stocks, SPACs) took sharp turns lower.

However, markets may be starting to stabilize. Only time will tell whether the sharp rebound in stocks since Mar 9 was temporary, or if markets are ready to trend higher once again.

That said, no matter the direction of the overall market, there are some top performing companies that could reflect great investment opportunities in the near-term.

What are some examples? Let’s check out these five compelling stocks to consider in March 2021.

Top Growth Stocks in March

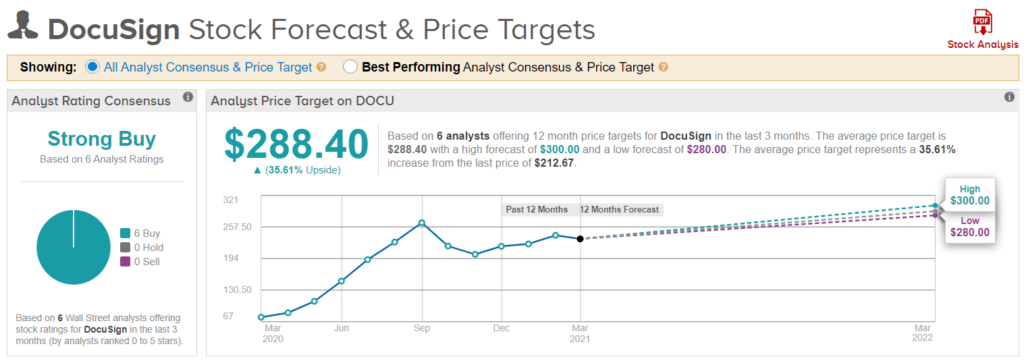

DocuSign (DOCU)

One of 2020’s best performing stocks, the e-signature company’s shares continued to gain at the start of 2021. But, along with tech stocks in general, DocuSign has made a sharp turn lower, selling off from its highs of around $265 per share, to below $200 per share.

If shares stabilize from here, projected growth this year (46.9%) and the next (32.2%) may be enough to send it back towards its prior highs (above $290 per share).

According to TipRanks’ Analyst Rating Consensus, shares come in as a “Strong Buy.” As for price targets, the sell-side has an average price target on DocuSign stock of $288.40 per share.

Micron (MU)

As TipRanks’ Marty Shtrubel wrote Mar 5, after several quarters of depressed sales, demand for DRAM memory chips is coming back into Micron’s favor. Investors know this full well, as seen from the stock’s strong performance since November.

After rallying from $50, to near $90 per share, investors have cooled a bit on the stock. But, based on analyst ratings, shares may have room to rally into the triple-digits.

The average price target on MU stock is $112.92 per share. Across-the-board, analysts see the stock as a “Strong Buy.” Out of 25 analyst ratings, 23 rate it a “buy,” 2 rate it a “hold,” and 0 rate it a “sell.”

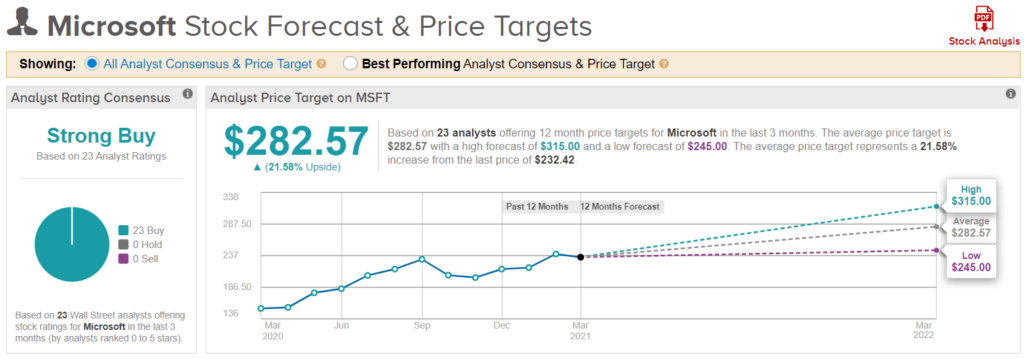

Microsoft (MSFT)

Scores of tech companies have thrived in the past year, as “remote work” has become the norm. With its high exposure to growth in cloud computing, Microsoft has benefited greatly from this trend as well.

After its more than 47% rally, some may think MSFT stock is done making new highs. Especially as focus shifts from pandemic plays to recovery plays.

Yet, the analyst community remains highly bullish. Coming in as a “Strong Buy” based on Analyst Rating Consensus, with 23 sell-side analysts covering the stock rating it a “buy.” If tech stocks continue to rebound from February’s sell-off, Microsoft shares could continue to climb as well.

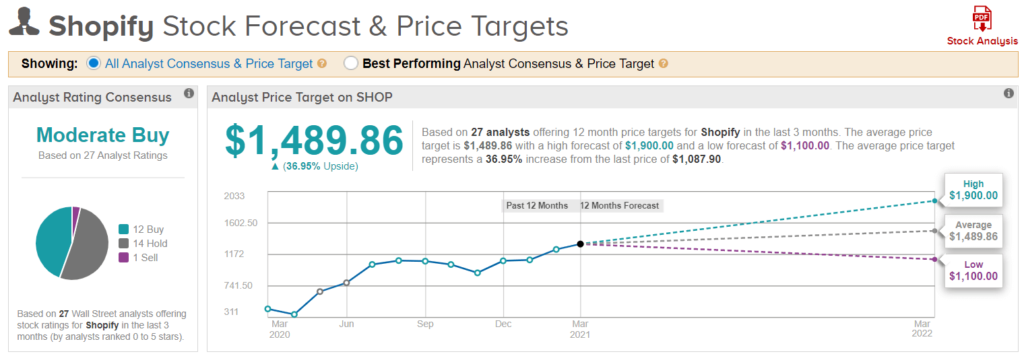

Shopify (SHOP)

Once the pandemic ends, is e-commerce going away? Don’t count on it! And, while shares are a bit frothy at today’s valuation (forward P/E ratio of 436.6x), this bodes well for SHOP stock.

The provider of SaaS software for online retailers benefited greatly from the shift to online shopping due to Covid-19 related lockdowns. But, even as this trend fades, growth may be sufficient enough to justify a full rebound, after the stock’s 25% slide from all-time highs.

As seen from its Analyst Rating Consensus, the sell-side is divided on its future price moves. Price targets vary widely as well. But, even if analysts are mixed on its prospects, shares could still climb, if tech stocks continue to rebound in March.

Uber Technologies (UBER)

Again, like with Shopify, valuation may be a concern with Uber stock. Despite its high market capitalization ($102.6 billion), the rideshare and food delivery app operator continues to operate in the red.

Nevertheless, with investors more excited about its continued ability to scale up, issues with profitability may not limit its ability to gain further in the near-term.

At least, that’s what’s implied by analysts. With the stock’s Analyst Rating Consensus coming in as a “Strong Buy,” 25 out of 28 analysts rating it a “buy.” With a price target of $71.88 per share (36.1% above today’s prices), UBER stock, holding steady at around $55.30 per share, may be ready to breakout.

Conclusion

Weighing the impact of higher interest rates on stock valuations, against the possible positive results of Covid-19 lockdowns coming to an end, it’s tough to assess where stocks overall are heading.

But, with these five top performing companies showing great potential in bouncing back from their recent losses, consider these some of the best opportunities for investors out there in March 2021.

Disclosure: Thomas Niel held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.