The 5 Best Healthcare stocks to buy in March 2024 have gained bullish reviews from Wall Street analysts. The healthcare sector in the U.S. is one of the largest employers and is expected to grow in the coming years. The ceaseless demand for healthcare services keeps the players on their toes, with newer and improved innovations, drugs, and technologies flooding the market every now and then. Its no wonder that analysts have such a highly bullish view on some of the players that show promising potential with their offerings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The healthcare sector can be broken down into several smaller fragments, with popular ones being companies operating hospitals and medical facilities, biotechnology and pharmaceutical companies, medical equipment companies, and health insurance players. Often considered defensive picks, healthcare companies tend to outperform the broader market during times of economic uncertainty. With this background in mind, let us look at the five best healthcare companies to buy in March, as per analysts, with high share price appreciation potential in the next twelve months.

#1 Exact Sciences Corp. (NASDAQ:EXAS)

Exact Sciences is a molecular diagnostics company focused on early detection and prevention of cancer. It first started with the mission to detect and prevent colorectal cancer through its Cologuard stool test product for patients with an average risk of cancer. The company is now in the process of launching Cologuard Plus, which has shown promising results in its BLUE-C study.

The cancer screening and diagnostic test company reported a 20% annual jump in its Fiscal 2023 revenue to about $2.5 billion, with Screening revenue of $1.865 billion and Precision Oncology revenue of $629 million. In Q4 FY23, Screening revenue rose 21% and Precision Oncology revenue grew 12% compared to the prior year period. Meanwhile, the company’s net loss reduced to $0.27 per share from $0.72 per share reported in Q4 FY22.

For Fiscal 2024, Exact Sciences projects revenues in the range of $2.810 to $2.850 billion, with Screening revenue of $2.155 to $2.175 billion and Precision Oncology revenue of $655 to $675 million.

Is Exact Sciences a Good Stock to Buy?

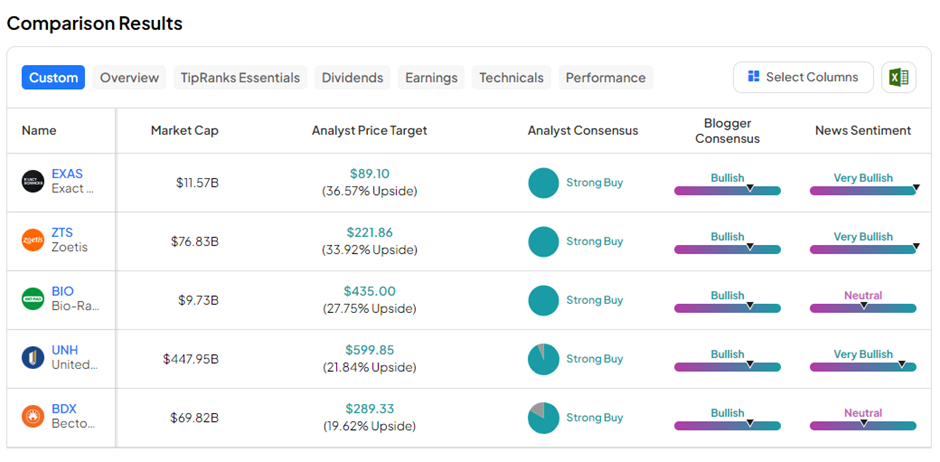

On March 19, Evercore ISI analyst Vijay Kumar added EXAS to the firm’s “Tactical Outperform” list, citing the undervalued stock price. Interestingly, 12 other analysts echo a similar sentiment for EXAS stock, giving it a Strong Buy consensus rating. On TipRanks, the average Exact Sciences price target of $89.10 implies 36.6% upside potential from current levels.

#2 Zoetis, Inc. (NYSE:ZTS)

Zoetis is the world’s largest manufacturer of medicines, vaccinations, diagnostics, and technologies for pets and livestock. The company’s revenue base is almost equally split between the U.S. and international markets. Spun off from the global pharma company Pfizer in 2013, Zoetis has made a mark for itself in the animal health segment.

For Fiscal 2023, Zoetis’ revenue grew 6% annually to $8.5 billion, while net income rose 9% to $5.32 per share. For Fiscal 2024, Zoetis guided for revenue of $9.075 to $9.225 billion and adjusted EPS of $5.74 to $5.84.

Is Zoetis a Buy or Sell?

On March 21, Argus Research analyst Jasper Hellweg reiterated a Buy rating on ZTS with a price target of $200 (20.7% upside). Hellweg thinks that the pullback in the shares of Zoetis, the industry leader in the animal health market based on revenue, offers a buying opportunity.

Six other analysts share the same sentiment for Zoetis, giving it a Strong Buy consensus rating. The average Zoetis price forecast of $226.14 implies 36.5% upside potential from current levels.

#3 Bio-Rad Laboratories, Inc. (NYSE:BIO)

Bio-Rad Laboratories develops, manufactures, and markets a wide range of innovative products for the life science research and clinical diagnostic markets. Its customers are mostly university and research institutions, hospitals, commercial laboratories, biotechnology, pharmaceutical, as well as food safety and environmental quality labs.

In Fiscal 2023, Bio-Rad’s net sales fell 4.7%, mainly due to the absence of higher COVID-related sales, excluding which net sales remained flat. At the same time, adjusted EPS of $11.78 was lower than the $14.42 per share reported in 2022 owing to fair value investment reporting. For Fiscal 2024, Bio-Rad expects currency-neutral revenue growth to be between 1.0% and 2.5%.

Is BIO Stock a Buy?

With four unanimous Buys, BIO stock has a Strong Buy consensus rating on TipRanks. The average Bio-Rad Laboratories Class A price target of $435 implies 27.8% upside potential from current levels.

#4 UnitedHealth Group, Inc. (NYSE:UNH)

UnitedHealth Group is a well-established multinational health insurance company. It offers a diverse range of healthcare coverage products and benefits through its UnitedHealthcare segment and technology-enabled health services through its Optum unit.

Unfortunately, UNH’s Change Healthcare system received a cyber-attack threat in mid-February owing to which it had to temporarily shut operations and is working to restore the system. This had far-reaching effects on its providers’ claims processes and medical prescriptions. UNH has advanced more than $3.3 billion to the affected care providers through its Temporary Funding Assistance Program at no cost.

In Fiscal 2023, revenues rose 14.6% annually to $371.62 billion while adjusted earnings grew 13.2% to $25.12 per share.

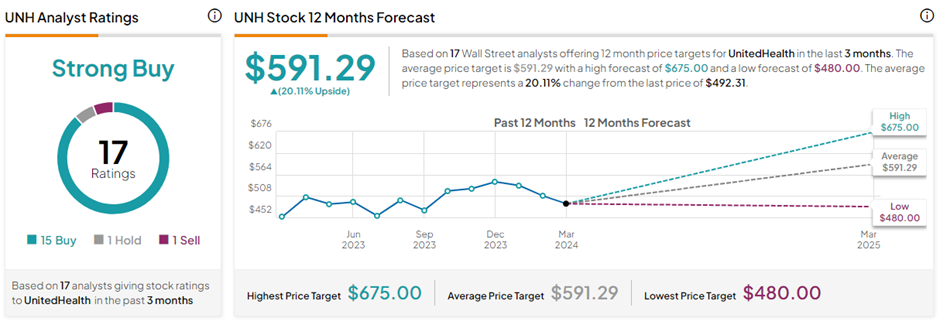

What is the Future Price of UNH Stock?

On TipRanks, the average UnitedHealth Group price target of $591.29 implies 20.1% upside potential from current levels. Also, UNH stock has a Strong Buy consensus rating, backed by 15 Buys versus one Hold rating.

#5 Becton, Dickinson & Co. (NYSE:BDX)

Becton, Dickinson (BD) is one of the world’s largest medical technology companies. Through its three segments, BD offers medical supplies, devices, instrument systems, lab equipment, reagents, and consulting and analytics services. Its primary customers are healthcare institutions, physicians, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public.

In Q1 FY24, BD’s revenue grew 2.6% year-over-year to $4.71 billion, while adjusted EPS declined 10.1% to $2.68 per share. The company raised its full-year Fiscal 2024 guidance modestly and expects revenue to be between $20.2 and $20.4 billion. Meanwhile, adjusted EPS is projected in the range of $12.82 to $13.06 per share.

Is Becton Dickinson a Good Stock?

With five Buys and one Hold rating, BDX stock has a Strong Buy consensus rating on TipRanks. The average Becton, Dickinson & Co. price target of $289.33 implies 19.6% upside potential from current levels.

Key Takeaways

The above 5 healthcare stocks have won analysts’ Buy ratings, thanks to their sound financials and solid history of growth. Investors seeking exposure to the defensive healthcare sector can consider these five stocks for their portfolios after thorough research.