3M Company (NYSE: MMM), in sync with its portfolio restructuring plans, has completed the divestment of its Dinac business for an undisclosed amount. The buyer in the transaction was Gerflor Group, a maker and supplier of wall coverings, floorings, and finishes.

3M communicated its intention to divest Dinac in December 2021. Shares of 3M increased 1.7% on Wednesday, closing at $147.22.

Headquartered in St. Paul, MN, 3M is a multi-sector conglomerate. Its presence is solid in safety, automotive, energy, healthcare, transportation, commercial solutions, electronics, consumer, and other markets.

Details of the Transaction

France-based Dinac has expertise in manufacturing and supplying floor products in the Western European region. Its revenues were roughly €25 million in 2021. As part of the transaction, Dinac’s stair nosing, flexible dashboards, and floor transition profiles together with 100 employees are now part of Gerflor. Manufacturing operations in La Mure were also part of the sale process.

It is worth mentioning here that Dinac was included in 3M’s construction and home improvement markets division of the Consumer segment. The segment has exposure in stationery and office, consumer health and safety, home improvement, home care, and other markets. Product offerings include paint accessories, home-cleaning products, braces, consumer respirators, bandages, and stationery.

The Consumer segment’s revenues were $5,856 million in 2021, reflecting an increase of 10.3% from the previous year. In 2022, the company anticipates the Consumer segment’s organic sales to increase in low- to mid-single-digit.

With this divestment, 3M intends to focus more on its other businesses within the construction and home improvement markets division. The addressable size of the home improvement market is $150 billion.

Other Notable Divestments/Acquisitions

In December 2021, 3M agreed to divest its food safety business to NEOGEN Corporation (NEOG) in a $5.3 billion transaction. The transaction is likely to complete in the third quarter of 2022. Before this, 3M divested its drug delivery business in May 2020.

Among 3M’s notable buyouts are M*Modal and Acelity, both completed in 2019 and added to the Health Care segment.

The abovementioned divestments and buyouts are part of 3M’s portfolio reshaping plans and are directed to boost the shareholders’ value.

Analysts’ Take

Recently, Stephen Tusa, an analyst at J.P. Morgan, reiterated a Hold rating on 3M while lowering the price target to $190 (29.06% upside potential) from $200. This update came in after the company communicated its margin projection for 2022 at its investor meeting.

Another analyst, Joshua Pokrzywinski of Morgan Stanley downgraded 3M’s rating to Sell from Neutral. It, however, maintained a price target of $150, suggesting a 1.89% upside potential from current levels.

3M has a Moderate Sell consensus rating based on 1 Buy, 7 Holds, and 5 Sells. The average 3M price target of $173.69 suggests 17.98% upside potential from current levels. Over the past year, shares of 3M have lost 14.6%.

News Sentiment

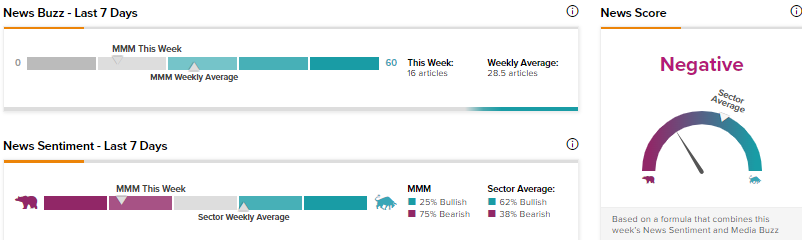

News Sentiment for 3M is currently Negative based on 16 articles over the past seven days. 75% of the articles on 3M have a Bearish sentiment, compared to a sector average of 38%, while 25% are Bullish, compared to a sector average of 62%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Lordstown Motors Slips 2.6% Pre-Market on GM Stake Sale Report

Energy Transfer to Sell 51% Stake in Canadian Business for $1.3B

BP to Sell Stake in Russia-based Rosneft Following Ukraine Invasion