Navigating the world of exchange-traded funds (ETFs) can be overwhelming, especially with so many options vying for attention.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To simplify your search, we have selected three ETFs currently rated as Outperform by the TipRanks AI analyst. Each fund offers a projected upside of at least 10%.

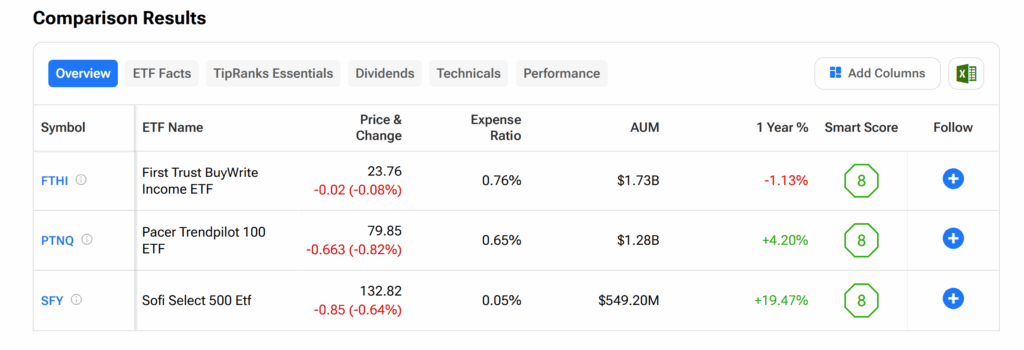

Explore the following chart and list to see how these top picks compare.

First Trust BuyWrite Income ETF (FTHI) – This ETF is targeted at income-focused investors and uses a buy-write strategy. This means the fund buys stocks such as Apple (AAPL) and Microsoft (MSFT), while also earning premiums by selling call options — typically on an index like the S&P 500 or on its own holdings. The fund was launched in 2014 by investment advisory First Trust Advisors.

The ETF AI analyst currently has a $27 price target on FTHI, suggesting more than 13% upside. The fund’s current Outperform rating is based on solid performance seen since the start of the year from its top holdings. These top holdings include companies such as Nvidia (NVDA), Broadcom (AVGO), and Microsoft (MSFT).

Pacer Trendpilot 100 ETF (PTNQ) — This ETF tracks the Nasdaq-100 index, which is heavily weighted towards tech companies, such as Apple, Nvidia, and Microsoft. The fund uses a trend-based model to shuffle between equities, treasury bills, or cash during market uptrends and downtrends. It was launched by Pacer ETFs in June 2015.

The ETF AI analyst currently has a price target of $90 on PTNQ, suggesting almost 13% upside. The fund’s current Outperform rating is supported by strong results from key holdings such as Nvidia, Broadcom, and Netflix (NFLX).

SoFi Select 500 ETF (SFY) — This ETF is a low-cost ETF that tracks the performance of the 500 largest companies in the U.S. The fund focuses on growth and heavily leans on the technology sector. It was launched in April 2019 by SoFi Invest, the investing arm of digital financial services firm SoFi (SOFI).

The ETF AI analyst currently has a $147 price target on SFY, suggesting about 11% upside. The fund’s current Outperform rating is based on solid year-to-date performance from top tech companies in its portfolio, including Nvidia, Broadcom, and Alphabet (GOOGL).