The benchmark crude WTI (CM:CL) has eked out a 1.5% gain over the past five sessions as traders digested the inflation data for April and tighter supply readings in the U.S. Meanwhile, after Europe, Nigeria looks set to drive more demand for U.S. oil.

Inflation Boost and Supply Dynamics

The consumer price index (CPI) came in at +0.3% for April, moderating from the prior +0.4% reading. The signs of cooling inflation weakened the U.S. dollar, making oil purchases attractive for international buyers. The latest data from the U.S. Energy Information Administration (EIA) indicated a decrease of 2.5 million barrels in crude inventories for the week ended May 10. The reading came in higher than the Street’s anticipated decline of 400,000 barrels. Numbers from the American Petroleum Institute (API) also pointed to a decrease of 3.1 million barrels in U.S. commercial stockpiles for the week ended May 10.

Buoyant Demand for U.S. Oil

These lower readings come just as summer travel demand for oil is expected to remain buoyant. Meanwhile, demand for U.S. oil is set to receive a boost from Africa’s largest oil producer, Nigeria. According to Bloomberg, the Dangote refinery in Nigeria is looking to buy 2 million barrels a month of WTI crude over the next year. Dangote’s push for U.S. oil also points to Nigeria’s struggles in lifting its own oil production.

While demand for U.S. oil looks set to remain buoyant, Russia is facing lower revenues from its oil exports. The country’s energy exports declined by nearly 6.4% month-over-month in April. Recently, lower European energy imports from Russia have led to elevated U.S. oil exports to the region.

Is Crude Oil Bullish, Bearish, or Neutral?

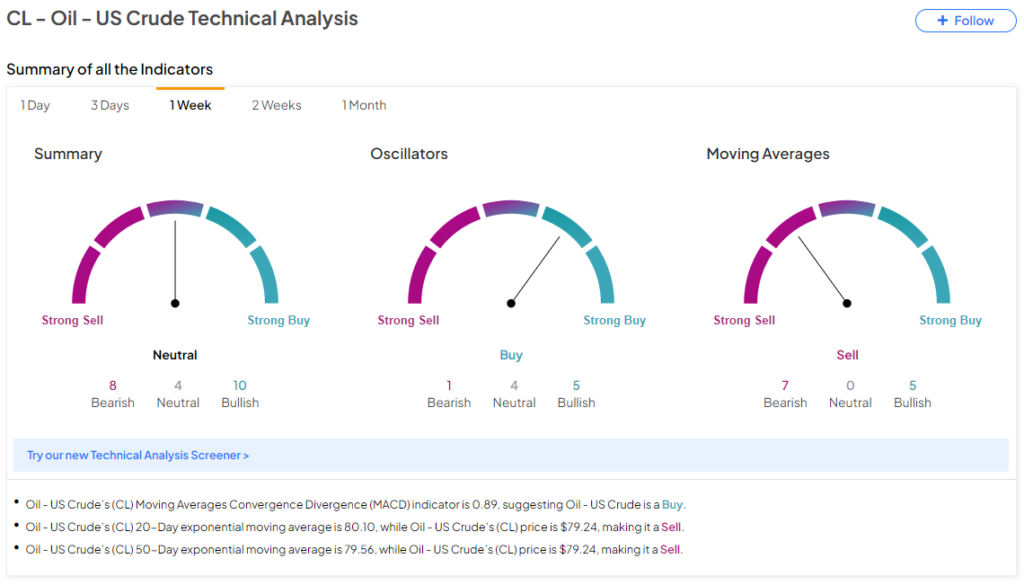

However, the next trajectory for global oil supply hinges on OPEC’s upcoming meeting next month. The organization is set to decide whether to continue, unwind, or extend its voluntary production cuts on June 1. Amid this dynamic, the TipRanks Technical Analysis tool is flashing a Neutral signal for oil on a weekly time frame at present. This indicates that a cautious approach may be warranted before initiating new positions for traders.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure