Solayer, the new kid on the crypto block with a product reminiscent of EigenLayer, quietly opened restaking deposits on Solana (SOL-USD) Thursday afternoon. The invite-only period was capped at a cool $20 million. Users could restake SOL or invest in liquid staking products like mSOL, bSOL, JITOSOL, and INF.

Not sure what EigenLayer is and why Solayer is similar to it? That’s cool – there are so many names, upgrades, abbreviations, and new stuff coming out that even people like me who are in this space have a hard time keeping up!

EigenLayer on Ethereum (ETH-USD): EigenLayer introduced restaking, where you take staked tokens that secure Ethereum’s proof-of-stake blockchain and use them to secure additional layers of applications. This way, those staked assets aren’t just sitting there—they’re enhancing liquidity and generating extra yield.

Solayer on Solana: Solayer’s doing the same thing on Solana. It lets users restake SOL and liquid staking derivatives like mSOL, bSOL, JITOSOL, and INF to secure additional layers and participate in financial activities. This boosts liquidity and efficiency within the network.

Solayer Hits $20M Cap in Record Time

Unlike most Solana restaking protocols, which are as rare as a unicorn sighting, Solayer’s funding performance hit its $20 million cap in just 45 minutes. And it’s not just the usual suspects throwing their hats in the ring. Solayer is looking to raise $8 million at an $80 million valuation, with Polychain leading the charge, according to CoinDesk.

Details on Solayer are as scarce as hen’s teeth. According to their blog, the protocol has “been in the works since the end of 2023.” They dubbed the first deposit period “epoch 0,” with restaked assets locked until “epoch 3.” The roadmap promises a liquid restaking token called sSOL in epoch 6. While there is no word yet on the duration of each epoch, sSOL has been confirmed to be a Liquid Restaking Token (LRT).

Restaking on Solana: The Next Big Thing

Restaking is about staking your staked tokens again to secure another layer of applications. It’s like getting double-duty out of your assets. This boosts the security of the blockchain’s base layer and puts those idle staked assets to work, generating extra yield. By spreading security duties across multiple layers, restaking ups network resilience and maximizes staked tokens’ utility.

Solana’s mix of proof-of-stake and proof-of-history makes it ripe for restaking. Ethereum’s EigenLayer pioneered this concept, raking in over $150 million in venture funding and securing over $14 billion in TVL, according to DeFiLlama. Now, this brainchild has found a new home on Solana.

In a blog post, Solayer shared their excitement about leading the “scaling out” movement from the Solana base chain in the coming year. They’re not just talking; they’re doing.

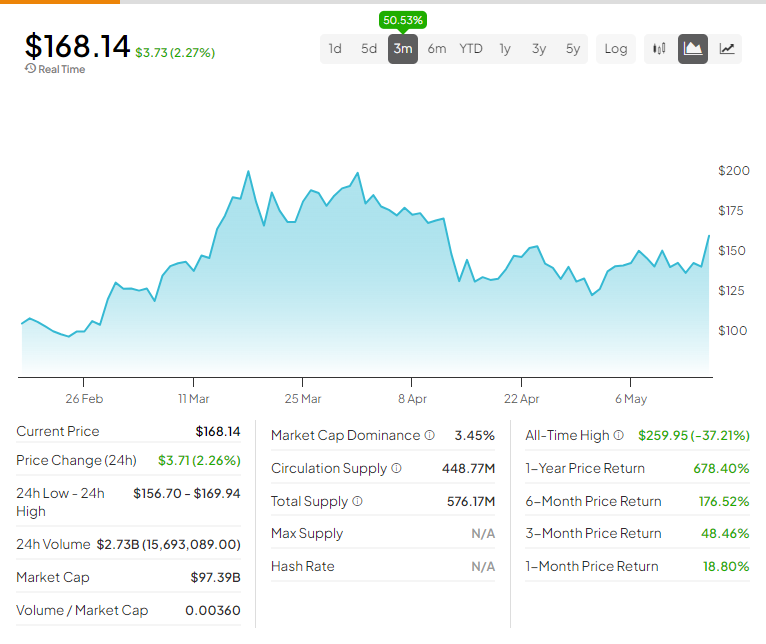

Is Solana a Buy?

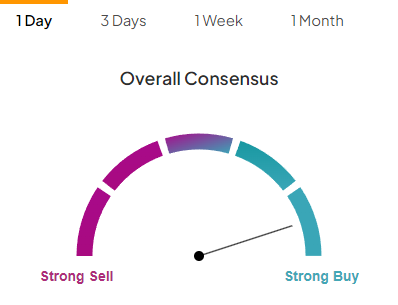

According to TipRanks’ Summary of Technical Indicators, Solana is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.