One of the biggest hot-button issues at work in the last year or so is the RTO, or Return to Office, mandate. Where 2020 saw businesses forcibly expel their workers, with government demands fueling a lot of that drive, 2022 and beyond saw businesses looking frantically to get back to normal. And it has not always gone smoothly. Reports note that tech giant Microsoft (NASDAQ:MSFT), among others, lost a lot of its talent due to RTO mandates. Investors, however, are taking it in stride as Microsoft is up fractionally in Tuesday afternoon’s trading.

A study conducted by the University of Chicago and the University of Michigan revealed that Microsoft, along with SpaceX and Apple (NASDAQ:AAPL), suffered a “…negative effect on the tenure and seniority of their respective workforce” thanks to RTO mandates. In fact, the study found that “…the strongest negative effects are at the top of the respective distributions, implying a more pronounced exodus of relatively senior personnel.”

These three firms represent about 2% of the tech sector’s workforce but account for a wildly disproportionate 30% of its revenue. Neither Microsoft nor SpaceX responded to the study, but Apple declared it packed with “inaccurate conclusions” that do “not reflect the realities of our business.”

Further Gaming Developments

On a brighter note, we know Microsoft is looking to advance in mobile gaming, and there’s plenty more in the works. We’ve still got better than half a year in gaming to go, and several developments are on tap. Microsoft revealed the lineup for the wave two lineup for Xbox Game Pass, which will include “Immortals of Aveum.” It’s also released a new update for a recent update to allow for partial downloading of update patches ahead of system launch. That should make the update process a little smoother for all concerned.

Is Microsoft a Buy, Sell, or Hold?

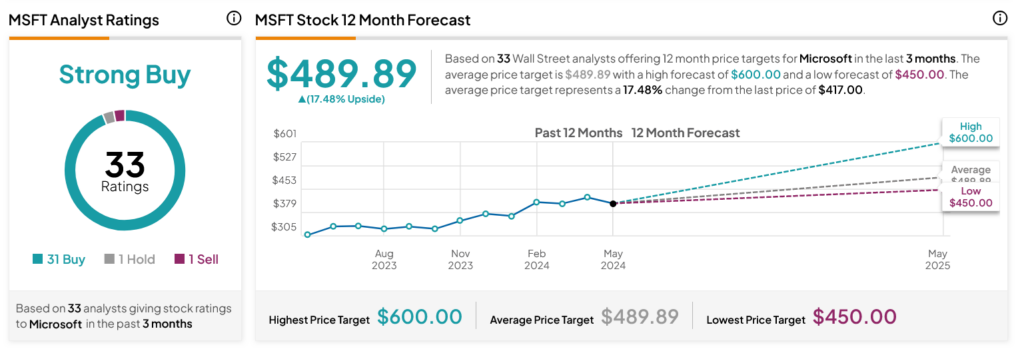

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 31 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 35.75% rally in its share price over the past year, the average MSFT price target of $489.89 per share implies 17.48% upside potential.