There was another $100 million settlement over trading surveillance at banking giant JPMorgan Chase (NYSE:JPM), but investors aren’t particularly fazed about it. In fact, JPMorgan shares were down just fractionally in Thursday afternoon’s trading despite another nine-figure check that needs to be written.

The latest round of penalties are connected to JPMorgan’s Corporate & Investment Banking (CIB) division, where JPMorgan maintained trade surveillance platforms. However, those platforms weren’t sufficient by government standards, and so, JPMorgan took a round of penalties for the failure. In fact, just back in March, JPMorgan took a $348 million fine over its failure to monitor trading.

The $348 million was owed to the Federal Reserve and the Office of the Comptroller. This latest $100 million fine is a new matter and will be going to a different regulator, but the third regulator in question wasn’t named.

The Russians Take Their Cut

If that weren’t bad enough, Russia also stepped in to levy fines against JPMorgan. A Russian court ruled in favor of VTB, a state-owned bank in Russia, over a matter of funds that had been blocked in other countries. JPMorgan sued VTB over the matter, seeking to get back $439.5 million, which would have been more than enough by itself to cover the latest round of fines in the US. However, the court instead ordered all JPMorgan funds to be seized, at least those in bank accounts in Russia. Securities and property connected to either JPMorgan funds or the jpmorgan.ru domain were left out of the seizures.

Is JPM Stock a Buy, Sell, or Hold?

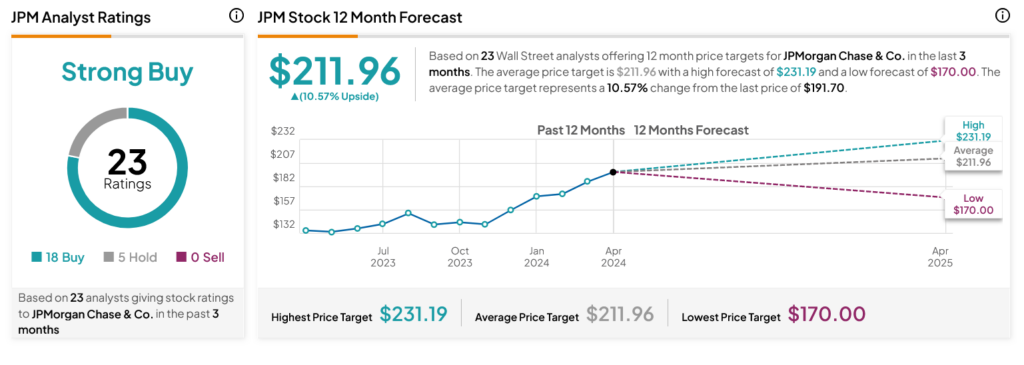

Turning to Wall Street, analysts have a Strong Buy consensus rating on JPM stock based on 18 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 44.49% rally in its share price over the past year, the average JPM price target of $211.96 per share implies 10.57% upside potential.