Gold (CM:XAUUSD) is down by nearly 0.26% today and by 1.2% over the past month as traders reassess their bets amid fast-shifting global dynamics. The current macroeconomic backdrop suggests that the consolidation in gold prices could persist for some time.

Diverging Interest Rate Trajectories

The weakness in gold coincides with the U.S. dollar maintaining its resilience, despite Fed Chair Jerome Powell recently suggesting that a rate hike was unlikely. Concurrently, comments from Neel Kashkari, the President of the Minneapolis Fed, imply that the current scenario of elevated interest rates could endure. Higher rates make gold less attractive to buyers, as the yellow metal does not yield any interest.

On the other hand, the interest rate trajectory in several other economies may favor gold in the coming months. The European Central Bank (ECB) looks set to reduce rates as inflation in the eurozone moderates. Moreover, Sweden, Switzerland, Hungary, and the Czech Republic are already gliding towards lower rates.

Meanwhile, China has been steadily increasing its gold reserves for 18 consecutive months. Another factor that could bolster gold in the short term is the possibility of geopolitical shocks.

Is Gold Bullish or Bearish?

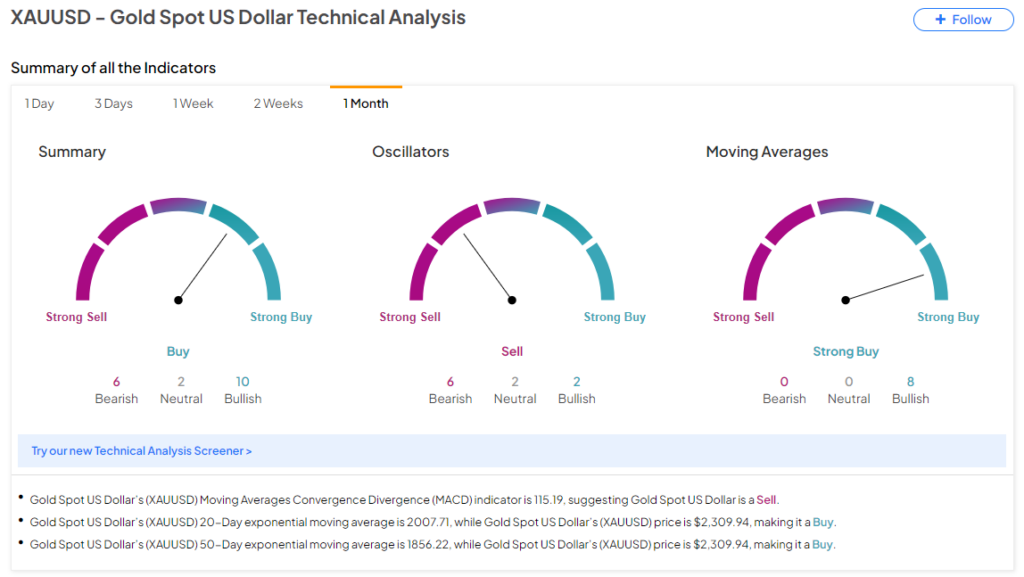

Consequently, gold could continue its consolidation over the next few sessions. Additionally, the TipRanks Technical Analysis tool too is flashing mixed signals for gold on a monthly timeframe. This indicates that a wait-and-watch approach may be warranted for now.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure