Gold (CM:XAUUSD) had been on the cusp of losing its glitter over the past few days as the U.S. Fed meet drew closer. Yesterday, the central bank left rates unchanged, while it waits for signs that inflation drawing closer to its 2% target.

Tracking Gold’s Glitter

While exactly how long it would take for inflation to hit that mark is anybody’s guess, gold traders are breathing a sigh of relief that at least a rate hike is not on the cards for the Fed. Higher rates make gold less attractive for investors as the yellow metal is a non-interest-bearing asset.

Nevertheless, gold is down by over 3% over the past week, and the current chart setup suggests prices are on weak footing as cooling tensions in the Middle East drain the safe-haven demand for gold. Despite this, gold prices could steadily climb up from the current $2,300 per ounce level over the rest of the year as supply-demand dynamics tilt heavily toward a super cycle in commodities.

Barrick Gold’s Q1 Confirms Recent Trend

The recent first-quarter results from Barrick Gold (NYSE:GOLD) squarely point toward this trend as the company’s subdued Q1 production was offset by higher prices. Barrick plans to steadily ramp up its gold production over the rest of 2024. Additionally, according to the World Gold Council, over-the-counter demand for gold stayed at its highest level in Q1 in nearly eight years.

Are Gold Prices Expected to Rise?

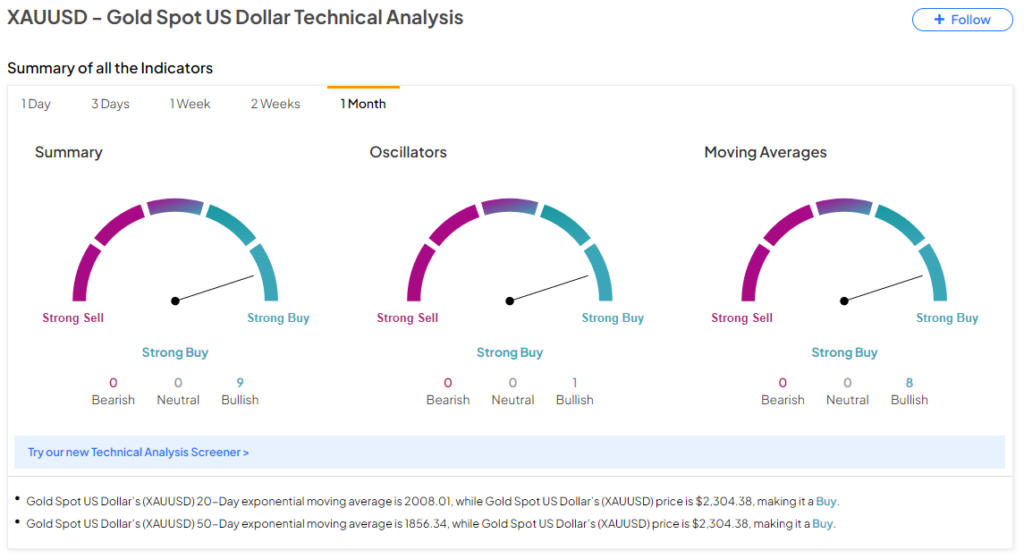

Importantly, while gold has been under pressure over the past few sessions, the TipRanks Technical Analysis tool too is flashing a Strong Buy signal for gold on a monthly timeframe. This indicates that investors could utilize further weakness in gold as a buying opportunity for the long term.

Ready to ‘commodi-tize’ your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure