In key news on Australian stocks, National Australia Bank Limited (AU:NAB) announced a share buyback plan of AU$1.5 billion, sparking investor interest despite lower profits in the first half of FY24. The bank reported a 12.8% decline in its cash earnings of AU$3.55 billion, reflecting growing competition in mortgages and deposits and high operating costs. Nevertheless, the NAB board decided to raise the company’s interim dividend by 1.2% to AU$0.84 per share and announced additional buyback authorization.

Investors responded positively to the modest increase in dividends and buybacks, resulting in a 1.45% rise in NAB shares on Thursday. Year-to-date, NAB stock has surged by 11%.

NAB is among the top four largest banks in Australia, serving a vast customer base.

Highlights of NAB’s First Half Performance

NAB’s revenue in the first half declined by 3.7% from the robust levels seen in the corresponding period of the prior year, due to increased competition outweighing the advantages of a higher interest rate environment. Meanwhile, cost pressures remained high, with operating expenses rising 5.8% to AU$4.7 billion.

Among its divisions, the Personal Banking unit significantly impacted performance, experiencing a 30% decline in cash earnings to AU$553 million. This reflects competitive pressures offsetting disciplined volume growth and benefits from the higher interest rates. On the other hand, the Business and Private Banking unit saw a modest 2.4% year-over-year decrease in cash earnings to AU$1.67 billion.

The NIM (net interest margin) declined by 5 basis points to 1.72% in the first half, leading to a slight decrease in net interest income to AU$8.397 billion.

Is NAB a Good Stock to Buy?

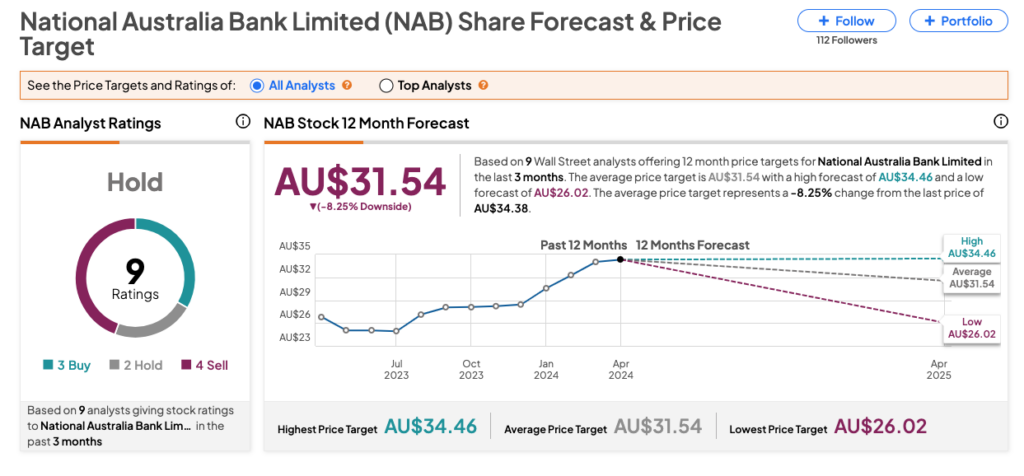

In terms of share price appreciation, analysts are not overly optimistic about the prospects. Following the results, UBS and Citi analysts maintained their Sell ratings on National Australia Bank stock, predicting an 18.5% and 25% downside, respectively. Meanwhile, Goldman Sachs assigned a Buy rating to NAB stock.

Overall, according to TipRanks, NAB stock has received a Hold rating based on three Buy, two Hold, and four Sell recommendations. The NAB share price target is AU$31.54, which is 8% lower than current trading levels.