We all knew that Boeing’s (NYSE:BA) delivery numbers weren’t going to be good for a while, especially with all the trouble from the government getting involved. In fact, Boeing’s latest delivery numbers did drop, but investors took it in stride and bought in regardless. As a result, shares of the aircraft maker are up modestly in Tuesday afternoon’s trading.

Boeing revealed that it delivered 24 aircraft back in April, which is actually down two against the already-weak figures seen in April 2023 that featured 26 aircraft deliveries. Worse, 33 orders were canceled outright, though that mostly stems from Lynx Air, the Canadian budget airline that shut down its operations in April.

Interestingly, for those who believe that the Federal Aviation Administration’s (FAA) restrictions are to blame, it turns out that’s just not so. Indeed, the FAA caps Boeing’s production to 38 planes per month. The latest numbers are slightly better than half that total.

Who Gets the CEO Spot?

Meanwhile, as Boeing works to sort out its quality problems and fends off whistleblowers at every turn, there’s still the matter of Boeing’s CEO to consider. It’s unclear just who will land that title, but there are two main players still in the running: Stephanie Pope and Steve Mollenkopf. Mollenkopf has a significant history behind him thanks to his tenure at Qualcomm (NASDAQ:QCOM), while Pope is an actual Boeing insider and the only one still remaining in the fray. Whether either of these is the best pick, however, remains to be seen.

Is Boeing Stock a Buy, Sell, or Hold?

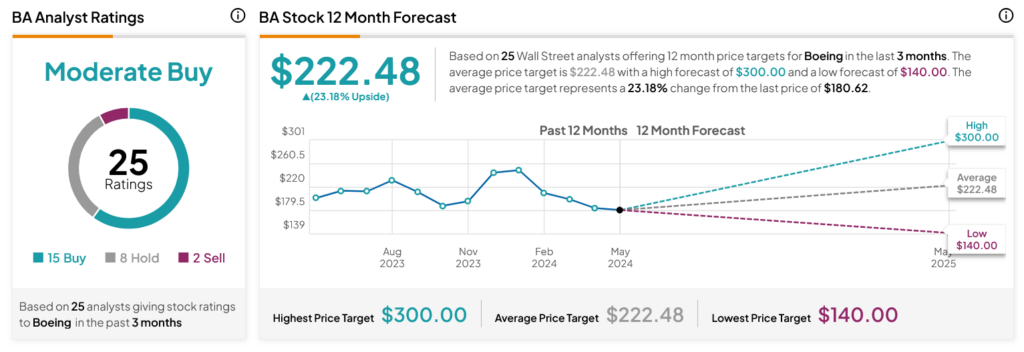

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, eight Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 10.82% loss in its share price over the past year, the average BA price target of $222.48 per share implies 23.18% upside potential.