B2Gold, Barrick Gold, and Agnico Eagle are 3 Best Gold Stocks to buy in May 2024, according to Wall Street analysts. We leveraged the TipRanks Stock Screener Tool to select the gold companies that analysts are highly bullish about. Currently, gold prices are trading near $2,390 per ounce, after spiking on May 15, 2024, following a cooler than expected U.S. inflation data for April (consumer price index).

The yellow metal is considered one of the best hedges against inflation. Gold prices work in inverse relation to economic factors such as interest rates, treasury yields, and the U.S. dollar price movement. There are several ways to invest in gold, including buying the physical metal, gold bars and coins, gold mining stocks, gold ETFs, and trading in gold futures. Investing in gold mining stocks can provide diversification to your portfolio.

The three gold companies discussed below are highly favored by analysts and could offer considerable share price appreciation in the next twelve months.

#1 B2 Gold Corp. (NYSEAMERICAN: BTG)

B2Gold is a low-cost international senior gold producer that owns and operates gold mines in Mali, Namibia and the Philippines. Plus, B2Gold has a mine under construction in northern Canada and numerous development projects in Mali, Colombia, and Finland.

In Q1 FY24, BTG reported gold production of 225,716 ounces, in-line with its expectations. The company posted adjusted earnings of $0.06 per share on gold revenue of $461.44 million. Also, the board announced a quarterly dividend of $0.04 per share for Q2, reflecting an above average yield of 5.69%. For Fiscal 2024, B2Gold projects total gold production between 860,000 and 940,000 ounces.

What is the Future of B2 Gold?

On TipRanks, the average B2 Gold price target of $4.26 implies 51.1% upside potential from current levels. BTG stock has a Strong Buy consensus rating, backed by nine Buys and two Holds. In the past year, BTG shares have lost 30.4%.

#2 Barrick Gold Corp. (NYSE:GOLD)

Barrick Gold boasts one of the largest portfolios of Tier One gold and copper assets in the industry. The company defines Tier One mine as one that will have a minimum production of 500,000 ounces per annum and a life of more than ten years. Barrick pays a quarterly dividend of $0.10 per share, reflecting an attractive yield of 2.35%.

In Q1 FY24, Barrick Gold produced 940,000 ounces of gold and 40,000 tonnes of copper. Further, the company reported 36% year-over-year jump in adjusted earnings per share (EPS) to $0.19 and a 4% growth in revenues to $2.75 billion.

For Fiscal 2024, Barrick Gold forecasts gold production of between 3.9 and 4.3 million ounces and copper production between 180 and 210 Kt (thousands of tonnes). The company is expecting to ramp up its gold production during the year, backed by the completion of the Pueblo Viejo plant expansion and the resumption of operations at the Porgera mine.

Is Barrick Gold a Good Buy Right Now?

With ten Buys and two Hold ratings, GOLD stock has a Strong Buy consensus rating on TipRanks. The average Barrick Gold price target of $22.54 implies 29.4% upside potential from current levels. GOLD shares have lost 7.1% in the past year.

#3 Agnico Eagle Mines Ltd. (NYSE:AEM)

Agnico Eagle is a senior gold mining company having operations in Canada, Australia, Finland, and Mexic. It also has development projects in the U.S. The company aims to build a high-quality, manageable business that generates superior long-term returns by increasing gold production in lower-risk jurisdictions, growing cash flows, giving meaningful dividends, and minimizing share dilution.

In Q1 FY24, AEM reported record gold production of 878,652 ounces. For Fiscal 2024, AEM projects gold production in the range of 3.35 and 3.55 million ounces. Moreover, the company announced a quarterly dividend of $0.40 per share (2.34% yield) and repurchased stock worth $19.9 million during Q1.

In Q1, AEM generated $1.83 billion in mining revenues, up 21.2% year-over-year. Meanwhile, adjusted EPS grew 31% to $0.76 compared to Q1 FY23.

Is AEM a Good Stock to Buy?

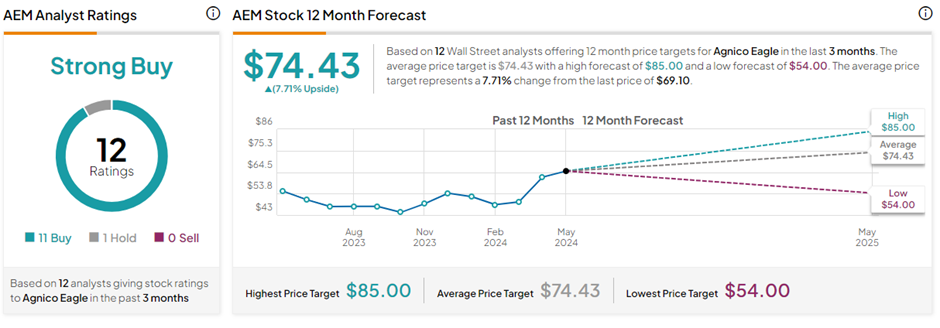

With 11 Buys and one Hold rating, AEM stock commands a Strong Buy consensus rating on TipRanks. The average Agnico Eagle price target of $74.43 implies 7.7% upside potential from current levels. In the past year, AEM shares have gained 23.7%.

Ending Thoughts

Gold is considered a safe haven investment during difficult economic conditions. Investors should have some exposure to the shiny metal in their portfolio. The above three gold stocks offer the potential for considerable growth in the future and have also won analysts’ bullish reviews. Investors can consider investing in these stocks after thorough research.