Verizon (NYSE:VZ) shares have surged by nearly 4% in the pre-market session today after its third-quarter EPS of $1.22 outpaced expectations by $0.04. Despite a 2.6% year-over-year decline, revenue of $33.33 billion landed in line with estimates

With a fourth consecutive quarter of over 400,000 net additions, the company’s total number of broadband subscribers now stands at nearly 10.3 million, including about 2.7 million fixed wireless subscribers. During the quarter, its total wireless service revenue ticked higher by 2.9% over the prior year to $19.3 billion. However, reduced wireless equipment revenue and a decline in postpaid upgrade activity impacted Verizon’s overall topline.

Importantly, Verizon’s focus on growing its wireless service numbers and driving free cash flow seems to be paying off. It now expects to generate a free cash flow of over $18 billion for the full Fiscal year 2023. This is an increase of $1 billion over the company’s prior outlook.

The company anticipates adjusted EBITDA in the range of $47 billion to $48.5 billion for the year, along with an adjusted EPS range of $4.55 to $4.85.

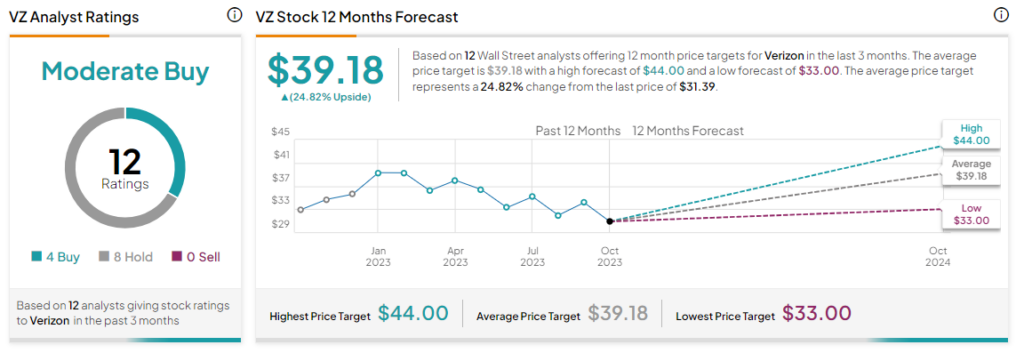

What Is the VZ Price Target?

Overall, the Street has a Moderate Buy consensus rating on Verizon. After a nearly 22% slide in its share price, the average VZ price target of $39.18 implies a 24.8% potential upside.

Read full Disclosure