Shares of airline company United Airlines (NASDAQ:UAL) gained in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Adjusted earnings per share came in at -$0.15, which beat analysts’ consensus estimate of -$0.57 per share. It’s worth noting that the firm would’ve seen a profit if it hadn’t been for a $200 million impact from the Boeing 737 MAX 9 grounding.

Furthermore, sales increased by 9.7% year-over-year, with revenue hitting $12.5 billion. This beat analysts’ expectations of $12.4 billion.

In addition, total revenue per available seat mile (TRASM) increased by 0.6% compared to the first quarter of 2023, while the cost per available seat mile (CASM) fell by 0.6%. However, CASM-ex (which excludes the impact of fuel expense, profit sharing, special charges, and third-party expenses) increased by 4.7% year-over-year.

Is United Stock a Good Buy?

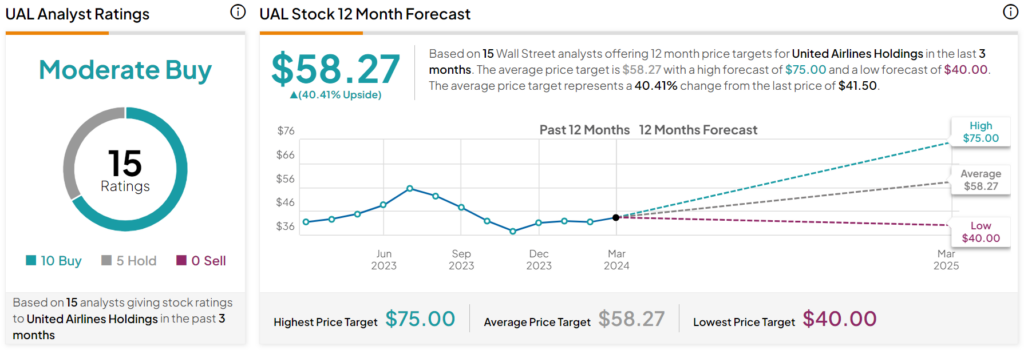

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UAL stock based on 10 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, after a 2.1% decline in its share price over the past year, the average UAL price target of $58.27 per share implies 40.41% upside potential.

Is It Wise to Allocate $1,000 Toward UAL Stock Right Now?

Before you hurry to invest in UAL, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and United Airlines is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.