After declining about 42% year-to-date, Tesla (NASDAQ:TSLA) stock has managed to reverse its course, jumping 13.33% in Tuesday’s after-hours trading. This growth came after the company said it was accelerating the launch of more affordable models. Despite the positive step of introducing more affordable electric vehicles (EVs), Tesla’s management maintained a cautious stance for 2024, expressing concerns about the volume growth rate. This cautious outlook could negatively impact TSLA’s short-term prospects.

It’s worth highlighting that Tesla reported weak Q1 numbers. The company posted a significant drop in its adjusted EPS in Q1 on April 23. The EPS of $0.45 dropped 47% year-over-year and missed the Street’s forecast. Also, revenues came in at $21.31 billion, below the analysts’ expectations of $22.256 billion.

Tesla to Accelerate New Model Launches

Tesla updated its upcoming vehicle line-up to accelerate the introduction of new models, including the cheaper versions. Investors cheered this update, as reflected by the jump in its share price. Tesla CEO Elon Musk said during the Q1 conference call that the company initially planned to produce these new models in the latter half of 2025. However, it expects to start production closer to early 2025, possibly late this year.

The forthcoming vehicles will leverage elements from the next-generation and existing platforms. Moreover, they will be manufactured on the same production lines as its current vehicle line-up.

The accelerated new model launches may reduce Tesla’s expected cost savings but will efficiently boost vehicle volumes.

Tesla Stock: Headwinds Persist

While Tesla is likely to benefit from the launch of the cheaper models, the ongoing macro and competitive headwinds could continue to be a drag in the short term. Tesla reported disappointing Q1 delivery figures, despite price reductions. This shows that global EV sales continue to remain under pressure due to elevated interest rates and sustained demand for hybrid models.

Adding to its challenges, the heightened competitive environment, especially in China, remains a concern and will continue to pressure pricing. Further, Tesla’s management added that its vehicle volume growth rate could be significantly lower than the growth rate achieved in 2023. All these headwinds could continue to restrict the upside potential in TSLA stock.

Is Tesla a Buy, Sell, or Hold?

Vijay Rakesh of Mizuho Securities noted the acceleration in new product launches, including low-cost EVs, is positive. However, the five-star analyst reiterated a Hold rating on TSLA stock after Q1 earnings. Rakesh sees challenges for Tesla in the near term, led by weakening EV demand and pricing pressures.

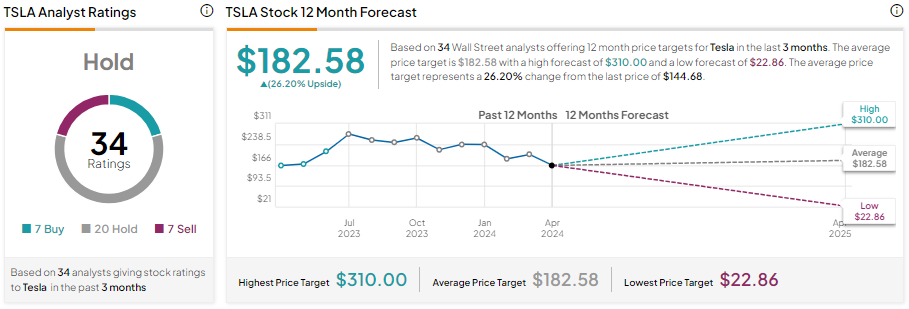

Overall, Tesla stock has a Hold consensus rating based on seven Buys, 20 Holds, and seven Sell recommendations. The average TSLA stock price target of $182.58 implies about 26.20% upside potential from current levels.

Bottom Line

The slowing EV demand and pressure on its margins due to lower average selling prices are likely to remain a drag on TSLA stock. However, the company’s focus on accelerating the launch of affordable models will likely push its volumes and support Tesla’s long-term growth.