In this piece, I evaluated two solar stocks, SolarEdge Technologies (NASDAQ:SEDG) and Enphase Energy (NASDAQ:ENPH), using TipRanks’ comparison tool to see which is better. A closer look suggests a bearish view for SolarEdge and a neutral view for Enphase.

Given the type of solar-related products they provide, SolarEdge and Enphase sit at the intersection of renewable energy with semiconductors. SolarEdge Technologies has developed a DC-optimized inverter system for harvesting and managing photovoltaic power and offers residential and commercial solar solutions and grid services. Meanwhile, Enphase Energy provides technology solutions for energy management in the photovoltaic industry.

Shares of SolarEdge have plummeted 25% year-to-date and are off 12% over the last three months, with a one-year plunge of 79%. On the other hand, Enphase Energy stock is off 8% year-to-date and has tumbled 43% over the last year.

We’ll compare their price-to-earnings ratios to gauge their valuations against each other and against that of their industry. For comparison, the renewable energy industry is trading at a P/E of 30.2 versus its three-year average of 417. Meanwhile, the semiconductor industry is trading at a P/E of 56.4 versus its three-year average of 31.8.

SolarEdge Technologies (NASDAQ:SEDG)

At a P/E of 110.4, SolarEdge is trading at a steep premium to both industries. While the solar industry, in general, has had a rough time as interest rates soared, SolarEdge appears to be in a worse financial state than others, suggesting that a bearish view might be appropriate.

About a week ago, SolarEdge received multiple price-target cuts following its latest round of weak earnings results and disappointing sales guidance. In the fourth quarter, the company’s revenue dropped 56% year-over-year to $316 million, missing the consensus estimate of $323.24 million.

SolarEdge also swung to an adjusted net loss of 92 cents per share from the year-ago profit of $2.86 per share. On the plus side, analysts had predicted a loss of $1.34 per share.

However, for the first quarter, SolarEdge guided for sales of only $175 million to $215 million, versus the consensus of $406 million. The company also called for an adjusted gross margin of between -3% and 1% — including about 850 basis points of net manufacturing tax credits from the Inflation Reduction Act.

This guidance isn’t just bad. It’s horrendous. In fact, zooming the picture out, SolarEdge has been teetering on the edge of profitability for some time, with its net margins ranging from 3% in 2022 to 1.2% in 2023, down from 8.6% in 2021 and 9.6% in 2020. This company just isn’t in good shape, so it may be best to avoid its stock for now, especially considering its high valuation.

What Is the Price Target for SEDG Stock?

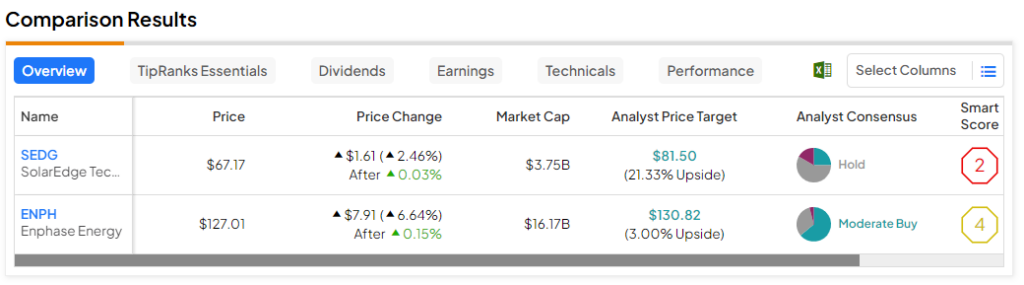

SolarEdge Technologies has a Hold consensus rating based on six Buys, 14 Holds, and four Sell ratings assigned over the last three months. At $81.50, the average SolarEdge Technologies stock price target implies upside potential of 21.3%.

Enphase Energy (NASDAQ:ENPH)

At a P/E of 38.6, Enphase Energy is much more reasonably valued than SolarEdge. However, while Enphase also appears to be in a much better financial position than SolarEdge, it could be some time before the solar industry recovers. Thus, a neutral view seems appropriate — pending the proverbial light at the end of the tunnel.

Like SolarEdge, Enphase missed earnings estimates for the fourth quarter. However, Enphase management also reported that the solar industry is starting to recover, which sent the company’s shares higher. As a result, Enphase expects demand for its products to start rising again after the first quarter.

In fact, Enphase insiders have been putting their money where their mouths are, as evidenced by a meaningful number of Auto Buy transactions by insiders last month. At that time, the company’s stock was tumbling, suggesting it may have been pinging the bottom price those insiders established in their pre-set trading plans. Those plans often include prices at which to automatically buy shares.

Since then, Enphase shares have rallied but then started to come back down, suggesting there could be more downside and potential buy-the-dip opportunities before the expected recovery occurs. In the meantime, the company has displayed solid execution in what has been a challenging period for the solar industry.

For the fourth quarter, Enphase reported earnings of 54 cents per share on $302.6 million in revenue, coming up only slightly short of the consensus numbers at 55 cents per share on $328.3 million in sales. However, what has been truly exceptional about the company is its margins.

With gross margins in the 40-46% range every year since 2020 and net income margins between 17% and 19% in all but one year since 2020, Enphase has made profitability a priority. In fact, management said on their third-quarter earnings call that they would continue to protect the company’s margins even amid weak demand. This focus on profitability is quite attractive in an industry where the growth-at-any-cost mindset often prevails.

Thus, when the solar market appears ready to bottom out, Enphase Energy would likely make an excellent long-term buy-and-hold position, given its long-term gains. The stock is up 1,231% over the last five years and 1,410% over the last 10. In fact, those who don’t want to wait could even consider buying a few shares now if they plan to hold them for the long term.

What Is the Price Target for ENPH Stock?

Enphase Energy has a Moderate Buy consensus rating based on 16 Buys, eight Holds, and one Sell rating assigned over the last three months. At $132.04, the average Enphase Energy stock price target implies upside potential of 4%.

Conclusion: Bearish on SEDG, Neutral on ENPH

Despite their similarities from a business standpoint, SolarEdge Technologies and Enphase Energy couldn’t be more different than night and day. Enphase has remained strong financially, even while the solar industry took a dive, but SolarEdge has displayed signs of weakness.

Thus, Enphase is the clear winner here, with timing being the only restraint on buying its shares. However, this stock is worth continual monitoring as the trough in the solar market approaches. In the meantime, investors may want to make preparations to pull the trigger on Enphase shares as they drop a bit further to a more attractive entry price and the recovery in the solar industry approaches.