UiPath (NYSE:PATH), a prominent player in enterprise automation and AI software, is experiencing a high market valuation, supported by solid market dominance and high revenue growth. Despite this high valuation, the company’s strategy of integrating AI with robotic automation processes suggests room for further growth. With AI-driven companies expected to see strong growth in the coming years, I’m bullish on the stock.

In Q4 2024, UiPath recorded a robust $405 million in revenue, marking a 31% year-over-year increase. Additionally, the company’s annual recurring revenue (ARR) during Q4 2024 reached $1.464 billion, a 22% year-over-year increase. The firm also operated with a remarkable 87% GAAP gross margin. Despite these strong financials, UiPath only realized its first GAAP profit in Q4, with GAAP operating income of $15 million corresponding to a 4% operating margin.

Investors should also note that the company has a forward P/E ratio of 37.5x, higher than the industry median of 25.1x. Analysts question whether the firm can meet strong earnings expectations, given its low operating margin. While they view the company’s robotic process automation (RPA) services as innovative and in high demand, UiPath’s high valuation pressures the company to achieve a robust growth rate.

Despite these concerns, analysts predict an 18% annual revenue growth rate for UiPath over the next three years, outpacing the industry average of 15%. They also forecast earnings per share to increase by 65% per year, which reflects PATH’s robust financial outlook. In my view, the stock is still attractive based on its strong ARR growth, robust earnings, and potential for market leadership in enterprise automation.

UiPath’s Steps to Expand Its Market

At the heart of UiPath’s market expansion strategy is its comprehensive platform, designed for automation that simulates human-user interaction. This platform is tailored for diverse company-wide applications, handling everything from straightforward tasks to complex business processes. UiPath generates revenue and broadens its market footprint by offering this proprietary software through license sales and coupling it with professional service support.

PATH’s Recent Partnerships

The company aggressively pursues partnerships to broaden its market reach. Last May, UiPath announced a partnership with Amelia to incorporate its Conversational AI into UiPath’s Business Automation Platform. The collaboration aims to provide customers with personalized employee experiences on a large scale and help businesses maximize their resources.

In February 2024, UiPath strengthened its partnership with Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Cloud, focusing on enhancing generative AI and cloud-based automation access. This collaboration allows customers to seamlessly integrate UiPath’s AI automation with Google Cloud’s Vertex AI and Workspace, streamlining business processes and collaboration.

“UiPath automation brings AI directly into business processes to help enterprises execute on whatever ideas and innovations they can imagine. Our partnership with Google Cloud is an essential part of our strategy to help joint customers achieve AI-powered automation across the business,” said Kelly Ducourty, Chief Customer Officer at UiPath.

In March, UiPath achieved authorization in the Federal Risk and Authorization Management Program (FedRAMP®), bolstering its presence in the public sector. This authorization allows UiPath to offer secure digital modernization solutions to government agencies. The company’s advanced AI and automation technologies already enhance operational efficiency and accuracy in U.S. federal and state governments. Their growing role in these areas highlights UiPath’s importance in the public sector.

PATH Gains Market Dominance

Last fall, Gartner’s (NYSE:IT) analysis revealed UiPath’s remarkable dominance in the RPA space, with a 35.8% market share. This substantial lead over competitors is underscored by the fact that no other competitor holds more than a 10% share. UiPath has quickly gained market share since 2016, when it had only a 1.6% market share. Gartner attributes UiPath’s success to its strong financial performance, global recognition, growing partnerships, and emphasis on AI-powered automation.

UiPath Exhibits Impressive Financial Performance

UiPath’s strong financials are partly the result of a solid subscription base. For FY 2025, UiPath projects its ARR to be $1.725 billion to $1.73 billion, marking a significant 21% rise from the ARR of FY 2024. Rob Enslin, CEO of UiPath, described the ARR increase as “underscoring the meaningful outcomes our Business Automation Platform delivers for its customers.” The platform uses AI to pinpoint opportunities for continuous process optimization and automation, focusing on those with the highest return on investment.

UiPath management anticipates FY 2025 revenue between $1.555 and $1.560 billion, a 16% increase from FY 2024 annual revenue. The company expects adjusted free cash flow to hit $350 million in FY 2025, translating to a 22% margin. This figure significantly exceeds the adjusted free cash flow of $146 million in FY 2024.

Additionally, the company forecasts its FY 2025 non-GAAP operating income to be $295 million, substantially higher than the consensus estimate of $260 million. This forecast represents a 165% increase over FY-2024 non-GAAP operating income of $111 million. The increase signifies a strong upward financial trend for the company.

However, the company’s guidance paints only a partly positive picture for Q1 2025. UiPath guidance foresees Q1-2025 revenue reaching between $330 million and $335 million, an 18% decline from Q4 2024. Likewise, PATH’s Q1-2025 EPS estimate is $0.12, significantly lower than the EPS of $0.22 achieved in Q4 2024.

Is PATH Stock a Buy, According to Analysts?

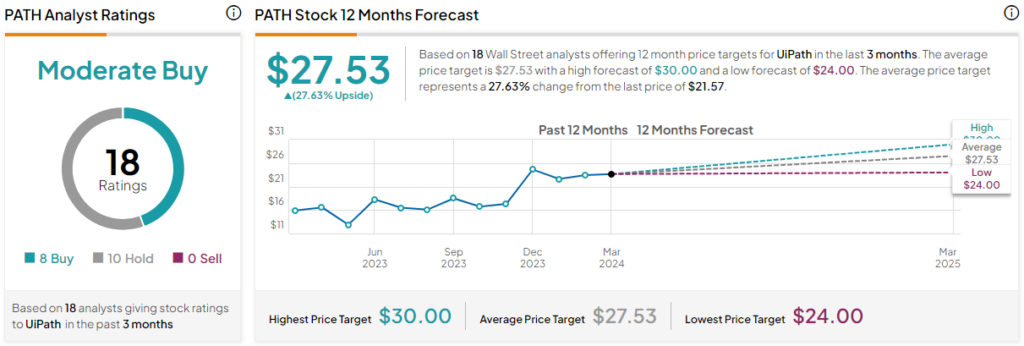

According to TipRanks, PATH is currently rated as a Moderate Buy based on eight Buys, 10 Holds, and no Sell ratings from analysts over the past three months. The average UiPath stock price target is set at $27.53, implying 27.6% upside from its last price. These analyst price targets vary, ranging from a low of $24.00 per share to a high of $30.00 per share.

The Takeaway

PATH’s high valuation, as reflected by its high P/E ratio, is in response to its remarkable earnings and revenue growth in Q4 2024. Despite the stock’s premium valuation, though, investors remain attracted to its capability to integrate AI with robotic automation.

Investor enthusiasm is also supported by the company’s growing profitability and impressive annual revenue growth. Additionally, a Gartner report recently highlighted UiPath’s strong position in the RPA market, reinforcing expectations for its ongoing growth and influence in the industry.