Shares of Oracle (NASDAQ:ORCL) declined about 9% in after-hours trading yesterday after the company reported mixed results for the fiscal second quarter and provided weak Q3 revenue guidance. ORCL is a provider of cloud-based solutions for enterprises.

Q2 Earnings Snapshot

The company’s Q2 adjusted earnings per share increased over 11% year-over-year to $1.34, surpassing analysts’ estimates of $1.33. Meanwhile, revenue increased 5% to $12.9 billion but missed the analysts’ estimates of $13.05 billion. The increase was driven by the strength of the company’s Cloud Services segment, which jumped 25.2% year-over-year to $4.78 billion.

Looking ahead, ORCL expects revenue growth between 6% and 8% for the current quarter, including contributions from its Cerner acquisition, which was closed in late 2022. This compares with the analysts’ expectations of about 7.5% growth. Additionally, the company anticipates adjusted profit to range from $1.35 to $1.39 per share.

Analysts’ Mixed Reactions Post-Q2 Results

Following the release of fiscal Q2 earnings, ORCL stock received mixed reactions from Wall Street analysts, as three analysts rated it a Buy and four assigned a Hold rating. Jefferies analyst Brent Thill maintained a Buy rating on the stock. He believes that Oracle can successfully navigate through the current challenges and capitalize on its market opportunities.

Is Oracle a Buy or Sell?

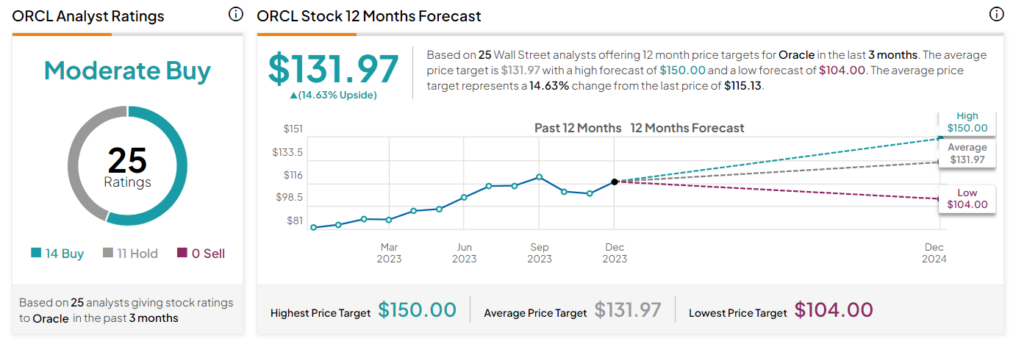

ORCL has received 14 Buys and 11 Hold recommendations for a Moderate Buy consensus rating. Further, the stock’s 12-month average price target of $131.97 implies 14.63% upside potential from current levels.