On Holding (NYSE:ONON) shares plunged by nearly 14% today after the Swiss sportswear products provider announced its results for the fourth quarter. Revenue increased by 21.9% year-over-year to CHF 447.1 million. However, the company churned out an adjusted net loss of CHF 16.3 million for the quarter. It had generated a net income of CHF 7.5 million in the comparable year-ago period.

In Q4, On’s net sales through DTC channels jumped by 38.2% to CHF 206.6 million. Similarly, its net sales through wholesale channels ticked higher by 10.7% to CHF 240.5 million. These sales gains also helped the company expand its gross margin to 60.4% from 58.5%.

The company remains optimistic about its growth prospects over the coming periods. For Fiscal Year 2024, On plans to grow its top line by at least 30%. Adjusted EBITDA margin for the year is seen hovering in the range of 16% to 16.5%.

Is On Holding a Good Buy?

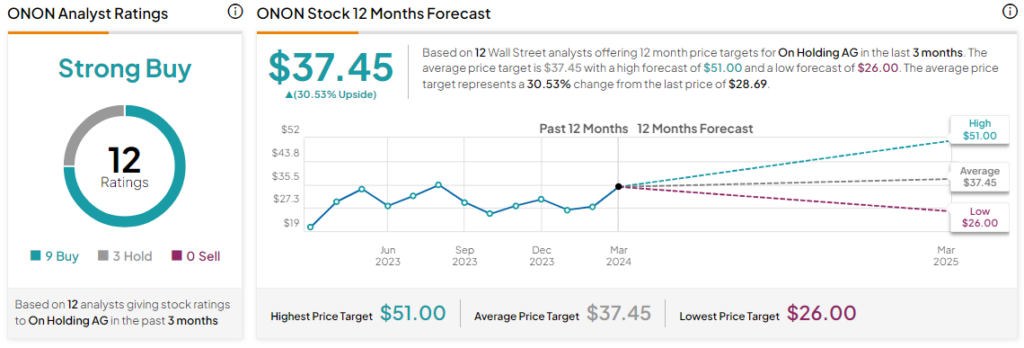

Even with today’s drop in price, the company’s shares are still up by almost 42% compared to the previous year. Overall, the Street has a Strong Buy consensus rating on On Holding, and the average ONON price target of $37.45 implies a 30.5% potential upside in the stock. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure