Shares of the leading connectivity cloud company Cloudflare (NYSE:NET) delivered better-than-expected Q1 financial numbers. Despite the Q1 beat, the stock dropped over 14% in Thursday’s after-hours trading. The management’s cautious tone and conservative Q2 guidance irked investors, dragging its stock lower.

Cloudflare’s leadership acknowledged that the operating environment is showing signs of improvement, as reflected in the increase in deal sizes for the company. However, persistent macroeconomic challenges continue to pose challenges and impact customer spending, prompting caution from NET’s management.

With this backdrop, let’s delve into Cloudflare’s Q1 performance and outlook.

NET’s Sales and EPS Exceed Expectations

Cloudflare delivered total revenue of $378.6 million, up 30% year-over-year, and exceeded analysts’ estimate of $373 million. This growth was fueled by an increase in net new customers (a large customer base) spending more than $100,000, $500,000, and $1 million with Cloudfare on an annualized basis.

Thanks to the leverage from higher sales, NET delivered adjusted EPS of $0.16, which doubled from the prior year quarter and surpassed Street’s forecast of $0.13.

Outlook Incorporates Macro Challenges

Cloudflare expects to deliver revenue in the range of $372.5 million to $373.5 million in Q2, representing a year-over-year increase of 28% to 29%. This compares favorably to the Street’s consensus estimate of $393 million.

Though Cloudflare’s revenue guidance exceeded analysts’ expectations, the outlook appears conservative considering the substantial growth in its large customer base, which annually spends $100,000, $500,000, and $1 million on its platform.

Given the macro challenges, Cloudflare reiterated its full-year guidance despite strong Q1 performance. The company expects its top line to be $1,648 million to $1,652 million. Further, it expects to deliver earnings in the range of $0.60 to $0.61 per share.

Is Cloudflare a Buy, Sell, or Hold?

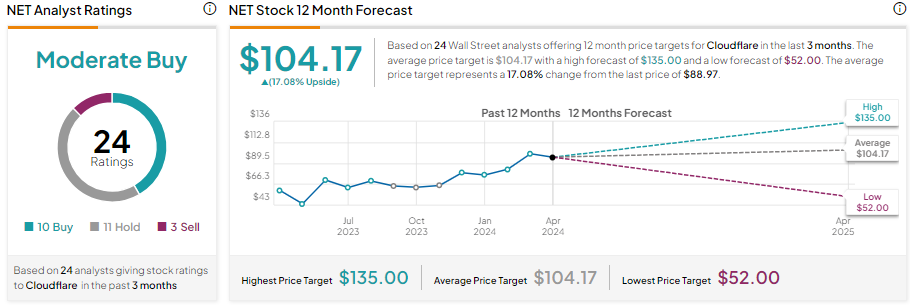

Cloudflare stock has more than doubled over the past year. Given this notable increase in its share price, Wall Street remains cautiously optimistic about NET stock.

With 10 Buys, 11 Holds, and three Sell recommendations, Cloudflare stock has a Moderate Buy consensus rating. Analysts’ average price target on NET stock is $104.17, which implies 17.08% upside potential from current levels.