While much of the market is focused on the action in mega-cap tech stocks, commodities are quietly heating up, as the prices of natural resources like crude oil and copper are surging.

As the natural resource sector gains momentum, I’m bullish on the SPDR S&P Natural Resources ETF (NYSEARCA:NANR) as an effective way to gain diversified exposure to stocks involved in a diversified group of commodities, including oil, natural gas, gold, copper, and beyond.

What Is the NANR ETF’s Strategy?

According to the fund, NANR invests in an index that “seeks to provide exposure to U.S. and Canadian publicly traded large and mid-cap companies within the sub‐industries of the energy, metals & mining or agriculture categories.”

Notably, the fund skews towards energy stocks and metals & mining stocks as each quarter, “The combined weight of securities of companies in the energy, metals & mining and agriculture categories are set at 45%, 35% and 20%, respectively.”

Can Commodities Keep Ripping?

Whether it’s oil, copper, or gold, commodities are quietly catching a major bid in 2024. Crude oil prices are up 19.4% year-to-date, while gold is up 11.2% so far in 2024. Meanwhile, copper prices are up nearly 6% in just the past month, surpassing $9,000 per ton. The diversified mix of energy and metals like gold and copper that NANR gives investors exposure to seems like a good place to be.

Commodities are gaining momentum, and they could have room to run based on a variety of compelling reasons.

Crude oil has surged to a five-month high, as geopolitical tensions in the Middle East have pushed prices higher. Oil prices are also benefiting from European countries looking to replenish their oil reserves, and supply could face further constraints as Russia has said it will further reduce production during the second quarter. In the U.S., demand for gasoline is picking up while inventories are falling. There are a lot of different factors at play, but they all paint a pretty compelling picture of oil prices staying higher.

Meanwhile, copper is benefiting from a slew of catalysts as well. Factory data in both the U.S. and China is improving. In China, the official manufacturing purchasing managers index notched its best reading of the year in March. In the U.S., manufacturing activity unexpectedly expanded after 16 straight months of declines. At the same time, copper could face supply constraints as China’s smelters consider production cuts, which should theoretically boost copper prices.

Carlyle Group’s (NYSE:CG) chief strategy officer of energy pathways, Jeff Currie (previously of Goldman Sachs (NYSE:GS)), recently told Bloomberg TV, “I want to be long oil and the rest of the commodity complex in this environment… The upside here is significant…” based on many of the factors discussed above.

Furthermore, if the Federal Reserve cuts interest rates, commodities could benefit further. Analysts from Goldman Sachs recently said that they expect commodity prices to rise more this year.

Goldman explained, “We find that U.S. rate cuts in non-recessionary environments lead to higher commodity prices, with the biggest boost to metals (copper and gold in particular), followed by crude oil… Importantly, the positive impact on prices tends to increase with time, as the growth impulse from looser financial conditions filters through.”

These factors all point to a favorable environment for commodities prices, and NANR gives investors exposure to a diversified basket of these stocks, as we’ll discuss below.

Holdings from Across the Commodities Space

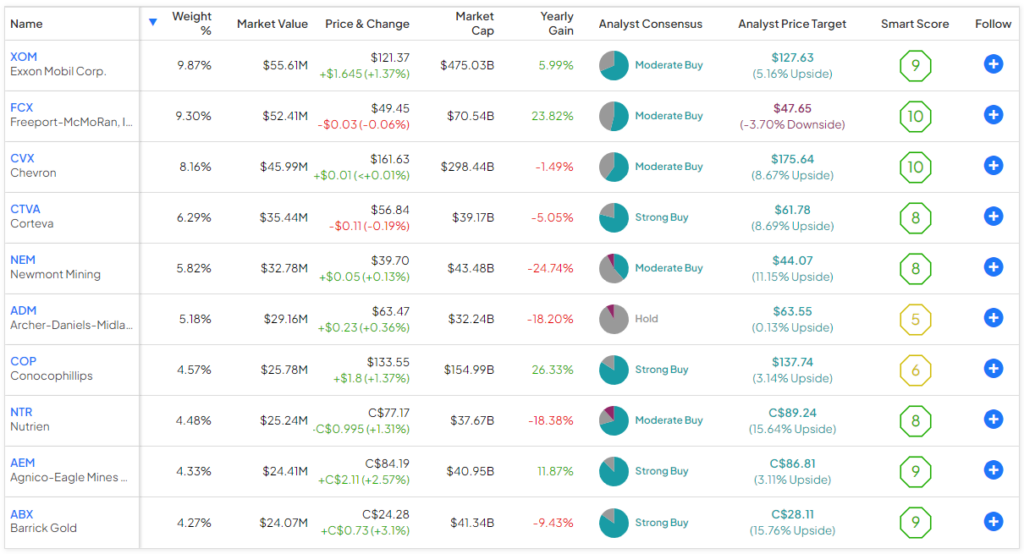

NANR owns 35 stocks, and its top 10 holdings account for 62.3% of assets. Below, you can check out a table of NANR’s top 10 holdings using TipRanks’ holdings tool.

As you can see on the table, energy giant ExxonMobil (NYSE:XOM) is NANR’s top holding, with a weighting of 9.9%, and it’s followed closely by Freeport McMoran (NYSE:FCX), the world’s largest copper producer, which has a weighting of 9.3%.

ExxonMobil is joined in the top 10 holdings by fellow energy stocks like Chevron (NYSE:CVX) and ConocoPhillips (NYSE:COP). Meanwhile, copper miner Freeport McMoran is joined in the top 10 by gold miners like Agnico Eagle (NYSE:AEM), Barrick Gold (NYSE:GOLD), and Newmont (NYSE:NMT).

Additionally, remember that stocks from the agricultural category are included in NANR and have a lesser but not insignificant 20% weighting after each quarterly rebalancing. Therefore, the stocks of companies that provide everything from seeds to fertilizers and herbicides, like Archer-Daniels-Midland (NYSE:ADM), Nutrien (NYSE:NTR), and Corteva (NYSE:CTVA), have a place within NANR’s top 10 holdings.

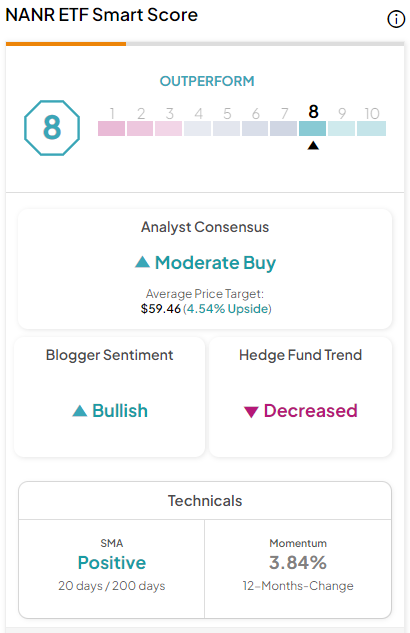

In addition to being involved in the extraction and production of various commodities, another thing these top holdings have in common, for the most part, is outstanding Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

In fact, an impressive eight out of NANR’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or higher. Freeport McMoran and Chevron both feature ‘Perfect 10’ Smart Scores. NANR itself earns a fantastic ETF Smart Score of 8 out of 10.

In addition to favorable Smart Scores, another appealing aspect of these holdings is that they are relatively cheap despite their strong recent performance. The ETF’s average price-to-earnings ratio is 16.1 — quite a bit cheaper than the S&P 500’s average price-to-earnings ratio of 23.6.

Does NANR Pay a Dividend?

Many energy and mining stocks are best known as dividend stocks first and foremost, so NANR is unsurprisingly a dividend payer and currently yields 2.5%. NANR has paid dividends to its investors for eight consecutive years.

What Is NANR’s Expense Ratio?

NANR charges an expense ratio of 0.35%. This means that investors in the ETF will pay $35 in fees on a $10,000 investment annually. While this is more expensive than many broad-market index ETFs, it is reasonable enough and cheaper than the average expense ratio for all ETFs (which is currently 0.57%).

Is NANR Stock a Buy, According to Analysts?

Turning to Wall Street, NANR earns a Moderate Buy consensus rating based on 30 Buys, six Holds, and zero Sell ratings assigned in the past three months. The average NANR stock price target of $58.69 implies 4.7% upside potential.

The Takeaway

In conclusion, I’m bullish on NANR, given the renewed momentum in commodities and the favorable setup for commodity prices. I especially like the fact that NANR gives investors exposure to a diversified mix of energy, metals and mining, and agricultural stocks, enabling them to benefit from the upside of all of these commodities with one ETF, as opposed to giving investors exposure to just gold, or just oil, for example.

I also like the fact that NANR’s top holdings collectively feature a strong group of TipRanks Smart Scores and that the ETF itself has an Outperform-equivalent Smart Score.