Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) have had a lot to announce regarding recent advancements in artificial intelligence (AI) over the last few weeks. Undoubtedly, the two Magnificent Seven members are often considered to be among the best ways to bet on AI, at least in the mega-cap tech scene. With market caps measured in the trillions and billions to be spent on various generative AI initiatives, investors may be wondering which company has the better shot of AI dominance.

After recent new AI technology unveilings for both companies and OpenAI, a firm in which Microsoft owns a huge stake (rumors suggest the ownership stake is in the ballpark of 49%), it seems like the AI race is getting a tad too close to call. Given that it’s still early days for AI, an argument could be made for owning both tech behemoths.

Further, investors should probably also hedge their bets, as an up-and-comer, perhaps Apple (NASDAQ:AAPL), has the resources to catch up. As others view the AI race as a sprint, I’m inclined to view it as a grueling, expensive, but totally worthwhile multi-year marathon. And with that, investors should stay in the know when it comes to their top AI investments. As it stands, I am bullish on both MSFT and GOOGL shares at current levels.

Therefore, in this piece, we’ll check TipRanks’ Comparison Tool below to compare Microsoft and Google to see which AI play may offer the better value proposition at today’s prices.

Microsoft (NASDAQ:MSFT)

It’s not hard to imagine that many investors flock to MSFT stock because of its deep partnership with and financial backing of OpenAI. Undoubtedly, the Sam Altman-led AI firm is arguably the hottest company in the world these days. And though Microsoft has been integrating OpenAI software across its software lineup, it’s important to remember that OpenAI isn’t the sole AI engine over at Microsoft.

While OpenAI has clearly been a driver for the largest company in the world, Microsoft has also been hard at work developing its own AI models, services, and even hardware. Indeed, it’s not all about OpenAI’s ChatGPT when it comes to Microsoft.

Just over a week ago, Microsoft unveiled its very own large language model (LLM) MAI-1 (Microsoft AI 1). It’s not only a rival to Google Gemini but also goes up against ChatGPT. Indeed, in such an uncertain AI race, it’s a good idea to have as many horses in the game as possible. In a similar fashion, Google also seemingly hedged its Gemini bets with its sizeable stake in Anthropic AI, the ChatGPT rival behind Claude.

Though not much is known about MAI-1, which is still getting the finishing touches put on, it reportedly boasts 500 billion parameters. While that’s less than ChatGPT-4 and its more than 1.5 trillion parameters, this may still be competitive once it’s ready to launch to the public. It’s not the number of parameters that matters most; the quality and optimization of said parameters also count.

With Mustafa Suleyman, one of the brightest minds in AI, leading the effort, I certainly wouldn’t bet against MAI-1 topping ChatGPT-4. Either way, Microsoft stands to win as its two “horses” shoot to win the AI race. Finally, let’s not forget about Microsoft’s coming AI chips, Maia 100 and Cobalt 100, announced last year. Such chips could be game-changers as they look to more efficiently power Microsoft’s own AI services, like Copilot.

All things considered, Microsoft stock looks to have a big lead over most firms in the AI race. That entails a premium price tag. The only question is whether the current multiple (31.15 times forward price-to-earnings (P/E)) is too rich. I don’t think it is.

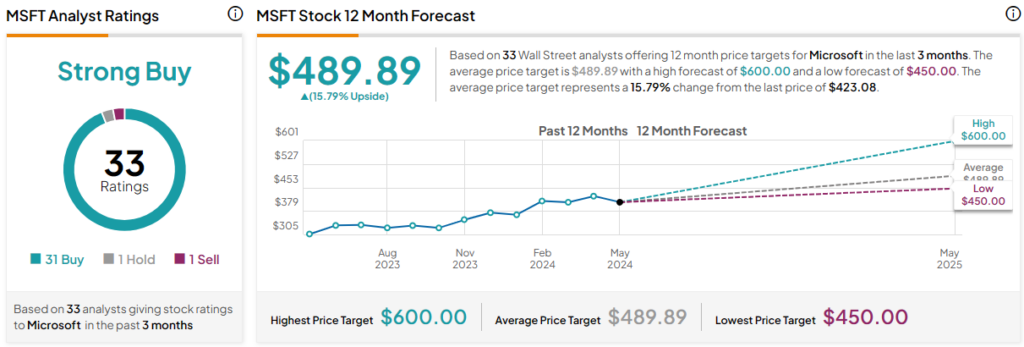

What Is the Price Target for MSFT Stock?

MSFT stock is a Strong Buy, according to analysts, with 31 Buys, one Hold, and one Sell assigned in the past three months. The average MSFT stock price target of $489.89 implies 15.8% upside potential.

Alphabet (NASDAQ:GOOGL)

Google gained some serious traction in AI this past week, with an impressive showing at its big AI day (better known as Google I/O 2024). There was quite a bit of new info for investors to digest after the conference, which was about as heavy on AI as it gets. In any case, it seems like Google may just have what it takes to challenge Microsoft’s early dominance as it looks to “floor it” on AI.

Google Gemini has been on the market for many months now, and it has held its own quite well. In the meantime, ChatGPT is the LLM to beat. Even if future iterations of Gemini prove far more capable than ChatGPT, I believe ChatGPT’s early move into the market could continue to work in its favor for some time.

After all, switching services is a hassle, especially if the potential gains are marginal at best. It will be interesting to see how much ground Gemini stands to gain as it looks to play catch-up in a race with no clear finish line.

With Google unveiling its powerful AI chip or Tensor Processing Unit (TPU) Trillium, Google also has stands to take the spot of third-party GPUs at many of its data centers. The chip reportedly boosted data center performance by close to five times. That’s seriously impressive.

Google may have given us all a horrendous first impression when it took its first steps in the AI race with the launch of Gemini, but since then, it’s begun to pick up speed. And I don’t think there’s any stopping the firm as it looks to pick up the pace while ensuring it does not stumble again.

What Is the Price Target for GOOGL Stock?

GOOGL stock is a Strong Buy, according to analysts, with 31 Buys and five Holds assigned in the past three months. The average GOOGL stock price target of $195.61 implies 13.4% upside potential.

The Bottom Line

As it stands, GOOGL stock is a powerful AI contender with a far lower P/E multiple than Microsoft. At 22.8 times forward P/E, almost 30% less than that of MSFT, GOOGL may very well be viewed as a distant runner-up. Personally, I think Alphabet is every bit as capable as Microsoft.

As such, I’d rather be a net buyer of GOOGL over MSFT here. But, of course, I believe investors should shoot to own both over the long run.