Shares of AI-empowered social media and metaverse innovator Meta Platforms (NASDAQ:META) slipped sharply after the company reported its first-quarter numbers, which were actually pretty good. Its earnings per share (EPS) came in at $4.71, well above the $4.32 consensus estimate. Still, the AI bills are going to get hefty, and that has some investors taking pause. As Meta continues investing heavily in the emerging technologies it truly believes in, most notably AI and the Metaverse, the risks stand to climb. But so, too, do the potential long-term rewards.

Perhaps adopting more of an “open” approach to the Metaverse and AI could help mitigate some of the risks. As Meta opts to create “a more open ecosystem” for its metaverse while also going to the open-source route with its LLaMA AI model, I’m inclined to stay bullish on Zuckerberg and his team as they look to advance two of the most exciting corners of tech while keeping the doors open.

Meta Platforms Stock: It’s Playing the Long-Term Game, After All

Undoubtedly, expenditures for its artificial intelligence (AI) and metaverse ambitions are not going to come cheap. And they may be “several years” away from achieving the big payoff that profitable growth investors have been hoping for; at least, that’s what Zuckerberg alluded to during Meta’s latest conference call. The same thing goes for the Metaverse.

The AI and metaverse efforts will cost tens of billions (if not more) to build up before the real profits can finally come raining down. Indeed, the Metaverse may be viewed as the riskier of the two endeavors, especially with AI already helping propel some of its recent quarterly results. In any case, both technologies are worth undertaking, even as some of Meta’s harsher critics throw in the towel because of their lack of patience.

In my opinion, advanced generative AI actually seems to be a natural accelerator to building a truly next-generation type of metaverse or virtual-reality experience. Don’t believe me? Just look at OpenAI Sora and the type of worlds it can create with just a bit of text. If Meta can create a powerful (but safe) text-to-3D model or world AI model, my guess is that its AI expenditures will help reduce a great deal of the future metaverse bills.

Meta AI Is Off to a Hot Start

Early signs for the recently launched Meta AI large language model (LLM) are encouraging, with “tens of millions of people” having “tried” the assistant since it landed. Still, it’s not yet clear how something like Meta AI will pull in substantial profits in the near term as the LLM goes against a number of competing products on the market. People have already been heading over to ChatGPT or Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) Gemini by default in the many quarters before Meta AI became available to the average consumer.

As AI advancements and unique innovations trickle in gradually over time, however, I wouldn’t be surprised if more people start using Meta AI over other LLMs. After all, it’s hard to avoid the assistant when it’s embedded across one’s favorite social media apps. As for the Metaverse, I also expect a slow trickle of innovations to draw in more users over an extended period of time — not exactly the formula for overnight gains, but perhaps one for steady and solid results over the next few years.

Personally, I view the latest dip in META stock as mostly due to the lack of patience on the part of some traders. To those seeking gains on a quarter-over-quarter basis, then sure, Meta will probably disappoint as it spends wildly to power many years’ worth of future growth.

More Spending, But Less Clarity on Revenue Growth

One of Meta’s biggest critics and the lone Sell rating holder on the stock, Stefan Slowinski of BNP Paribas, was turned off by its spending, going as far as to say the firm has “no new revenue streams to replenish its resources, which will also continue to be drained by its Metaverse adventures.”

Indeed, the pace of AI and metaverse spending may concern some. Still, I would not want to bet against Mark Zuckerberg, a relatively youthful visionary who knows better than most how to make money from new technologies. Though I disagree with Slowinski’s recommendation on the stock, I think his concerns are also on most investors’ minds after the latest quarter.

For longer-term investors who will be around long enough (let’s say three to five years) for Meta’s spending to begin really kicking in, I view Meta stock as incredibly undervalued right here at just 23.7 times forward price-to-earnings (P/E).

Could it be that the latest post-earnings correction makes META stock the cheapest of the Magnificent Seven? I certainly think so, even if not all analysts are on the bull wagon right here.

Is META Stock a Buy, According to Analysts?

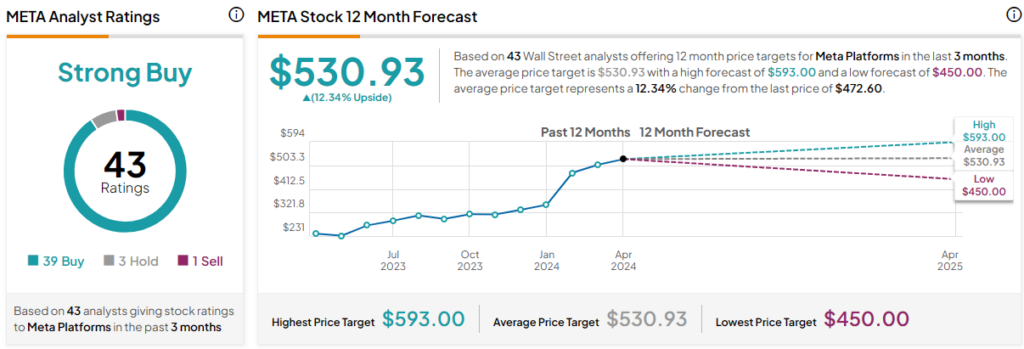

On TipRanks, META stock comes in as a Strong Buy. Out of 43 analyst ratings, there are 39 Buys, three Holds, and one Sell recommendations. The average META stock price target is $530.93, implying upside potential of 12.3%. Analyst price targets range from a low of $450.00 per share to a high of $593.00 per share.

The Bottom Line

Meta is betting big on AI and the Metaverse, even if it takes a few more years to supercharge revenue and profits. Zuckerberg has always played the long-term game, and as he looks to open the doors to two remarkable frontiers, I’d only suggest loading up on META stock if you seek high growth, are comfortable with Zuckerberg’s aggression, and plan to stay invested for at least a few years.