Natural gas producer EQT Corp. (NYSE:EQT) is acquiring Equitrans Midstream (NYSE:ETRN) in an all-stock deal. Equitrans is a former unit of EQT.

The M & A move is expected to create a vertically integrated natural gas business with an EV (enterprise value) of more than $35 billion. For EQT, the deal is a way to better compete with its vertically integrated global peers by creating a large-scale, integrated natural gas producer in the U.S. with a low-cost base.

Further, EQT gains over 2,000 miles of pipeline infrastructure with overlap and connectivity in its core area of operations. The combined entity will have 27.6 TCFE (Trillion Cubic Feet Equivalent) of proved reserves and 6.3 BCFE/Day (Billion Cubic Feet equivalent) of net production.

Further, the acquisition is expected to generate annual synergies of $250 million and $16 billion of cumulative cash flow between 2025 and 2029. Under the all-stock deal, each outstanding ETRN share will be exchanged for 0.3504 shares of EQT.

The deal is anticipated to close in the fourth quarter of 2024. Following this combination, current investors of EQT will own about 74% of the combined entity.

Is EQT Stock a Good Buy?

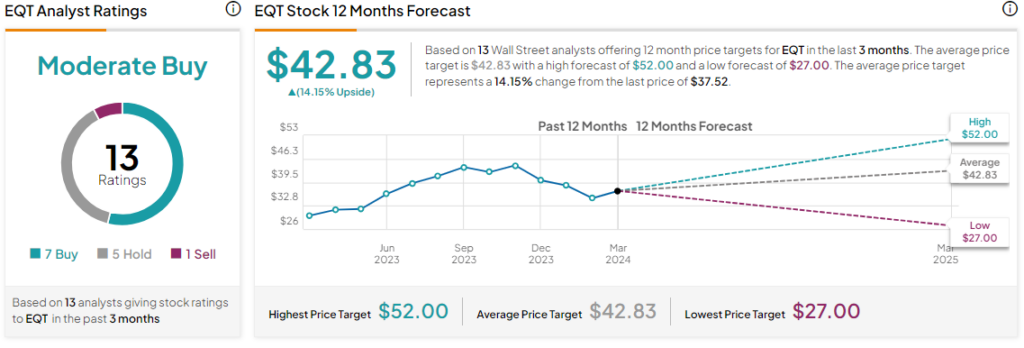

Today’s announcement has sent ETRN shares nearly 6% higher. In contrast, EQT’s stock price is trending nearly 6% lower. Overall, the Street has a Moderate Buy consensus rating on EQT alongside an average price target of $42.83. However, analysts’ views on the stock could see changes following the announcement of the deal.

Read full Disclosure