Investors can use the TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame. Today we have shortlisted two retail stocks, The Kroger Co. (NYSE:KR) and Costco Wholesale (NASDAQ:COST), as they are scheduled to release their results tomorrow, March 7. Both companies saw their web traffic surge in the to-be-reported quarter, which could have boosted their revenue.

These retail chains offer a wide range of products, including groceries, electronics, furniture, drugs, and more. The performance of both Kroger and Costco might have been supported by improved consumer spending trends and a strong holiday season.

Let’s take a closer look at both companies’ website traffic trends and the analysts’ expectations about their upcoming earnings reports.

The Kroger Co.

According to the tool, Q4 total visits to both kroger.com and thekrogerco.com were up 49.8% from last year’s quarter. In the fourth quarter, about 130.1 million users visited Kroger’s websites, including 44.7 million on desktop devices and 85.4 via mobile units.

Interestingly, Wall Street also expects the company’s revenue and earnings to have risen year-over-year. Analysts expect adjusted earnings of $1.13 per share, which compares favorably with $0.99 in the year-ago quarter. Further, revenues of $37.07 billion are expected to have increased by 6.5%.

What is the Forecast for KR Stock?

On TipRanks, Kroger has a Strong Buy consensus rating based on three Buys and one Hold rating. The average Kroger stock price target of $53 implies a 7.1% upside potential from current levels. Shares of the company have gained 11% over the past six months.

Costco Wholesale

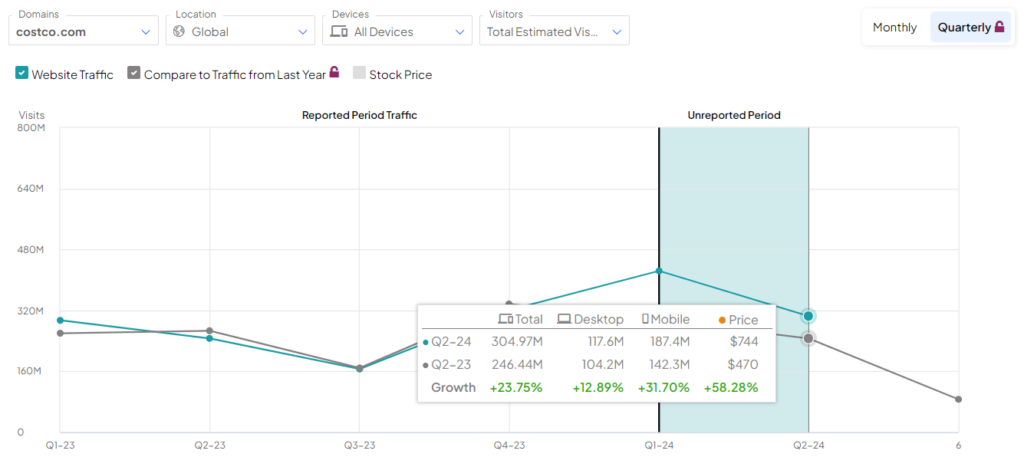

As per the website traffic tool, total visits to costco.com were up 23.8% year-over-year during the Fiscal second quarter. The company’s website traffic jumped to 305 million visits from 246.4 million in the year-ago quarter.

As for the Street’s expectations, Costco is expected to post earnings of $3.62 per share in Q2, nearly 10% higher than the prior-year period. Similarly, sales are projected to rise 6.9% to $59.11 billion.

Is COST Stock a Buy or Sell?

Wall Street is optimistic about Costco stock. It has a Strong Buy consensus rating based on 21 Buys and seven Holds. After about 43% rally over the past six months, the average COST stock price target of $727.59 implies 4.2% downside potential.

Concluding Thoughts

According to web traffic data, both COST and KR witnessed upbeat business growth during the quarter. Also, it points to an encouraging top-line performance in the upcoming results.

Thus, investors could make the TipRanks’ Website Traffic tool a part of their stock research strategy, as an indicator of a company’s online engagement and potential future performance.

Learn how Website Traffic can help you research your favorite stocks.