Shares of air carrier JetBlue Airways (NASDAQ:JBLU) plunged nearly 8% in the pre-market session today after its third-quarter EPS of -$0.39 lagged expectations by $0.14. In sync, revenue declined by 8.2% year-over-year to $2.35 billion, missing estimates by $30 million.

JetBlue’s third-quarter quarter was characterized by an adverse impact from weather events and higher fuel prices. While the company increased its system capacity by 7.1%, operating expenses per available seat mile (CASM ex-fuel) inched up by 5.9% over the year-ago period.

Amid a difficult operating environment, JBLU expects cost savings of nearly $70 million from its structural cost program this year. The savings run-rate from the program is expected to further rise to $150 million to $200 million through 2024.

While travel demand is expected to tick higher during the fourth-quarter holidays, the industry is facing challenges from overall capacity outstripping domestic demand during off-peak travel periods. Amid this dynamic, JBLU expects revenue in the fourth quarter to decline by between 10.5% and 6.5%, with EPS ranging between -$0.55 and -$0.35.

However, for Fiscal year 2023, JBLU expects revenue growth to be between 3% and 5%, alongside an EPS range between -$0.65 and -$0.45.

What Is the Target Price for JBLU Stock?

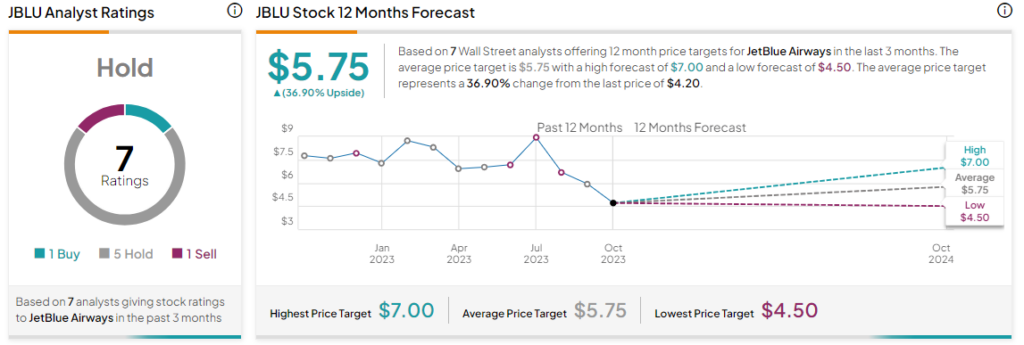

Overall, the Street has a Hold consensus rating on JetBlue. The average JBLU price target of $5.75 implies a 36.9% potential upside. That’s after a nearly 48% slide in the share price over the past year.

Read full Disclosure