Legendary investor Warren Buffett’s Berkshire Hathaway (BRK.A) continues to ramp up its stake in oil and gas giant Occidental Petroleum (NYSE:OXY). Following the completion of the recent transaction, Berkshire’s stake in Occidental has increased to 27.7% from 27%.

In an SEC filing, Berkshire disclosed the purchase of 5.18 million shares of Occidental in multiple transactions between December 19 and December 21. These purchases were made at prices ranging from $59.49 to $60.50, for an aggregate price of $312.1 million. It is worth highlighting that the “Oracle of Omaha” now owns 243.8 million shares of Occidental, worth $14.67 billion, based on Thursday’s closing price.

Interestingly, Buffett had purchased over 10.4 million shares of Occidental last week for an aggregate price of $588.6 million. These purchases follow the company’s move to acquire Midland-based oil and gas producer CrownRock. The deal, expected to close in Q124, would increase Occidental’s Permian Basin production capacity by 170,000 barrels of oil equivalent (boed) per day to 750,000 boed.

Berkshire Hathaway – A Top-Rated Insider

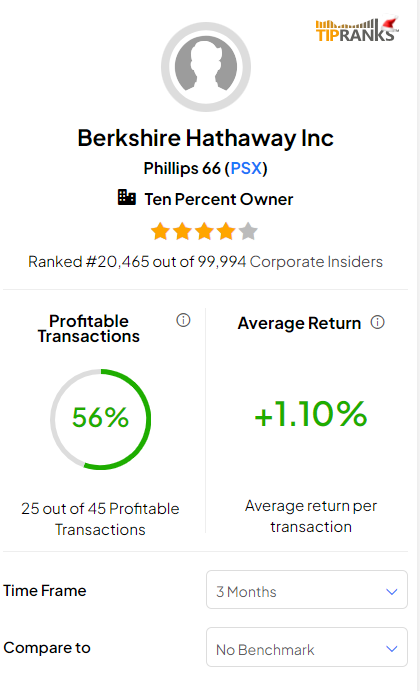

Berkshire is one of the Top-rated insiders. TipRanks tracks and measures the performance of several financial experts and ranks them based on three key factors: success rate, average return, and statistical significance.

As per the data collected by TipRanks, Berkshire has had a 56% success rate in its 45 transactions in the past three months, with an average return of 1.1% per transaction.

Investors should note that TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

What is the Forecast for OXY?

Wall Street analysts are cautiously optimistic about Occidental. It has a Moderate Buy consensus rating based on eight Buys, nine Holds, and one Sell. The average OXY stock price target of $69.13 implies 14.4% upside potential. OXY stock is down 2.9% year-to-date.