Rivian (NASDAQ:RIVN) stock took investors on a roller-coaster ride today, falling ~10% in early trading before bouncing back to close the day just above the break-even point. The reason, as you might have guessed, is earnings.

There was quite a bit to digest in Rivian’s Q1 readout with food for thought both for the bulls and the bears. The EV maker beat expectations on the top-line with revenue increasing by 81.5% year-over-year to $1.2 billion and edging ahead of consensus by $30 million. However, the company delivered a bigger loss than expected, with adj. EPS of -$1.24 falling short of the Street’s call by $0.08.

Adj. FCF also missed, showing -$1.523 billion vs consensus at -$941 million, which the company put down to heightened Accounts Receivable and Inventory levels anticipated to diminish as the year unfolds.

On each vehicle delivered in the quarter, Rivian lost $38,784, while the company also dialed in a bigger gross profit miss than anticipated, hitting -$527 million vs. consensus at -$348 million. The figure also factored in $171 million in costs and accelerated depreciation with management noting that this should completely disappear by the fourth quarter.

On that note, the company remains positive it can reach its target for a modest gross profit in Q4, and reiterated its production guide for the year of 57,000 vehicles. Additionally, the capex guide was reduced by $500 million to $1.2 billion due to the company deciding to go ahead with the R2’s production at its Normal, Illinois plant while putting on the back burner the construction of a new facility in Georgia.

For RBC analyst Tom Narayan, Rivian’s fate rests on a successful ramp of the R2 and R3, although the analyst remains concerned about the competition, especially from legacy OEMs with “similar products offering compelling PHEV alternatives.”

“Ultimately,” Narayan went on to say, “Rivian is a show-me story. If it can indeed get to a positive Gross Profit for Q4/24, then we could see re-energized investor interest in the name.”

For now, Narayan remains on the sidelines with a Sector Perform (i.e., Neutral) rating and $11 price target, suggesting the shares have room for 7% growth from current levels. (To watch Narayan’s track record, click here)

On the other hand, Stifel analyst Stephen Gengaro has a generally more upbeat take. Looking at the results, the readout has done little to change his thesis.

“The company continues to make progress optimizing operating expenses and anticipates 2H24 operating expenses to be substantially lower than 1H24, enabling RIVN to start 2025 with a more efficient baseline cost structure,” Gengaro commented. “Overall, we view the print and outlook as about neutral for the shares.”

Gengaro stays with the bulls, maintaining a Buy rating on RIVN stock along with an $18 price target. Investors stand to score a 75% gain, should Gengaro’s thesis go according to plan in the year ahead. (To watch Gengaro’s track record, click here)

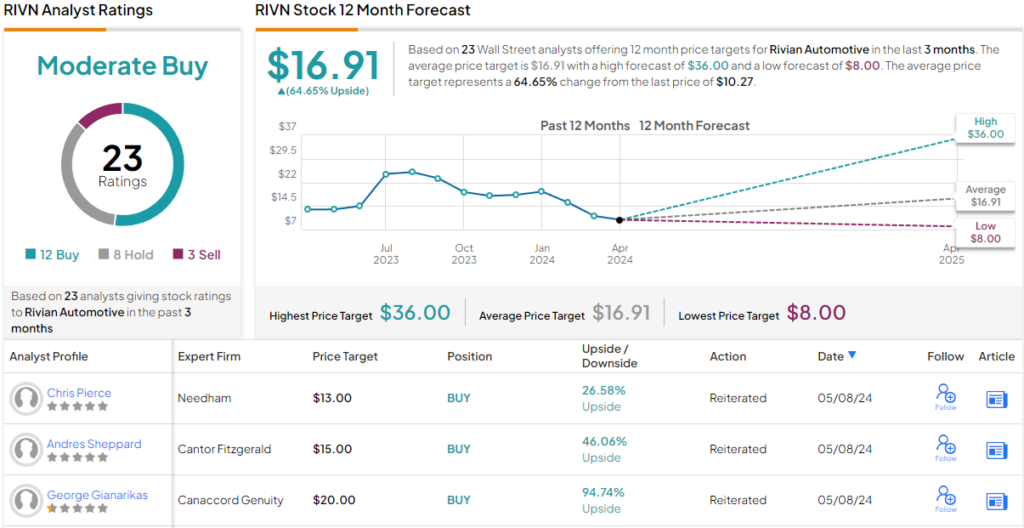

Most on the Street also stay on the bullish side. Based on a mix of 12 Buys, 8 Holds and 3 Sells, the stock claims a Moderate Buy consensus rating. The average target is an optimistic one; at $16.91, the figure makes room for 12-month returns of ~65%. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.