In key news on UK stocks, J D Wetherspoon PLC (GB:JDW) soared by 3.6% as of writing after the company released an encouraging update for the 13-week period that ended on April 28, 2024. Driven by solid numbers, the company now expects its annual profits for FY24 to be on the higher side of market expectations.

This came as a pleasant surprise for investors after the disappointing Q2 report released in March, which dragged the shares down. JDW stock has remained almost flat at 0.67% in the last 12 months.

J D Wetherspoon operates a network of pubs and hotels throughout the UK and Ireland, offering a diverse range of alcoholic and non-alcoholic beverages and food options.

Guinness Craze Boosts Wetherspoon’s Sales

According to Wetherspoon’s update, like-for-like sales increased by 8.3% year-to-date and 5.2% in the 13 weeks ended on April 28, 2024. Wetherspoon’s total sales grew by 3.3% in the quarter and 6.5% year-to-date.

Wetherspoon attributed its increased sales over the past three months to rising demand for Guinness beer among younger customers and a rebound in ale consumption. Additionally, Au Vodka from Swansea, XIX flavoured vodkas, and Lavazza coffee contributed to higher sales.

So far this year, the company has opened two pubs and divested 18 pubs, the majority of which were smaller and older or located close to another Wetherspoon pub. The disposals resulted in a net cash inflow of £6.8 million. Another 17 pubs are currently on the market for potential sale.

Is Wetherspoons a Good Stock to Buy?

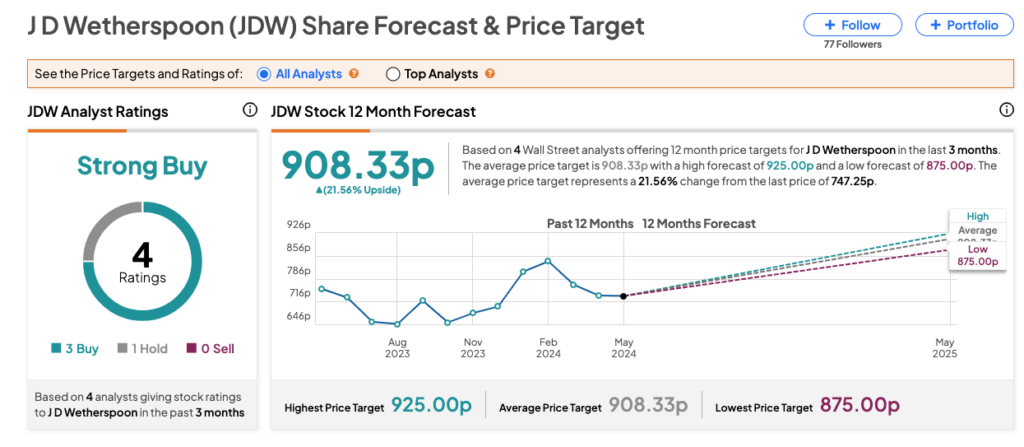

According to TipRanks, JDW stock has a Strong Buy rating based on three Buys and one Hold recommendation. The JD Wetherspoon share price forecast is 908.33p, which is 22% higher than the current trading levels.