Among the famous Hong Kong stocks, JD.com, Inc. (HK:9618) has recently garnered a bullish take from analysts, suggesting strong upside potential in the months ahead. This week, analysts from DBS and CGS-CIMB confirmed their Buy ratings on JD.com stock. They are optimistic about the company’s revenue and earnings growth.

Over the last 12 months, JD.com shares experienced a turbulent period, declining by 32% due to challenges in the retail market and broader macroeconomic worries in China. Nevertheless, analysts maintain an optimistic outlook on the company, foreseeing significant potential for the share price to rise.

JD.com is a leading e-commerce platform in China, offering products such as electronics, home appliances, and groceries.

Analysts’ Views on JD.com

Recently, analyst Tsz Wang from DBS reiterated his Buy rating on the stock, predicting an upside of 47%. Wang believes that the company’s diversification into new sectors, such as groceries and healthcare, will fuel additional growth. He expects revenue to experience a CAGR (compound annual growth rate) of 7% from FY23 to FY26, while adjusted earnings are projected to increase by 5% annually over the next three years.

Additionally, Wang sees the company’s robust logistics infrastructure as a key differentiator from its competitors, enabling the delivery of exceptional customer experiences and driving increased traffic to its marketplace.

Wang further highlighted three potential accelerators for JD’s share price growth: strong recovery in electronics and home appliances segments, margin enhancements from marketplace expansion, and potentially lower-than-expected expenses from the subsidy scheme.

Similarly, CGS-CIMB analyst Lei Yang also reiterated a Buy rating on the stock this week. Yang holds the most optimistic outlook on JD stock, projecting a staggering growth of 180%. Yang forecasts 12% year-over-year revenue growth for the company and 7% for JD Retail in the first quarter of FY24. This will even surpass China’s Q1 retail sales growth of 4.7%.

Is JD Stock a Good Buy Now?

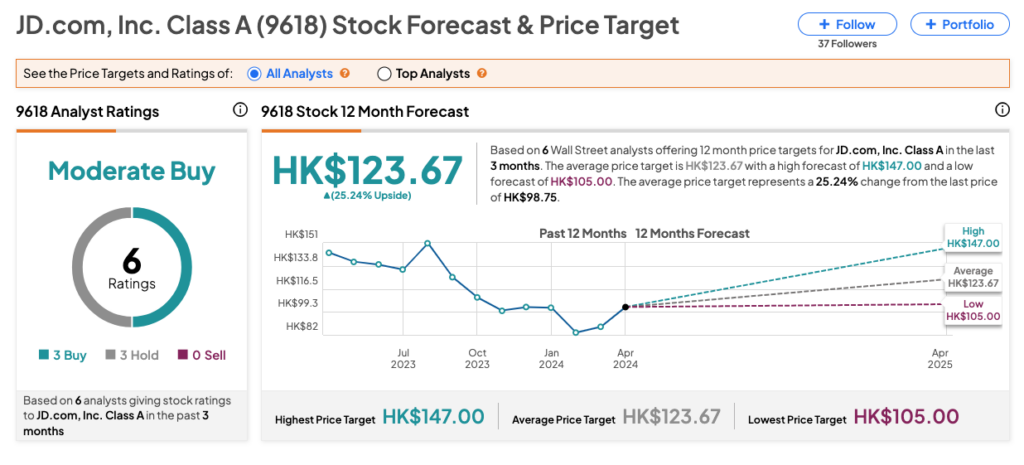

As per the consensus among analysts on TipRanks, 9618 stock has been assigned a Moderate Buy rating based on three Buy and three Hold recommendations. The JD.com share price target is HK$123.67, which implies an upside of 25% from the current price level.