Investors looking for reliable and steady income could consider these stocks, often referred to as Dividend Aristocrats (companies that have increased their dividends for over 25 consecutive years). General Dynamics (NYSE:GD), Becton Dickinson (NYSE:BDX), and Sysco (NYSE:SYY) are three such stocks that not only boast an impressive dividend history but also have an upside potential of more than 10%. Furthermore, Wall Street analysts are bullish on these stocks.

Now, let’s take a closer look at these three Dividend Aristocrat stocks.

Is GD Stock a Good Investment?

The aerospace and defense major has raised its dividends for 29 consecutive years. The company’s core aerospace and defense businesses are benefiting from the ongoing geopolitical tensions. This is attributed to the rising demand for military hardware and aircraft. Further, GD continues to invest in the adoption of new technologies, such as artificial intelligence (AI) and cybersecurity, which should further support its growth.

Among the 15 analysts covering GD stock, 12 rated it a Buy, and three assigned a Hold rating. The average GD price target of $295.73 implies a 10% potential upside from the current level. Shares of the company have gained 10% over the past three months.

It is worth mentioning that General Dynamics stock carries a “Perfect 10” Smart Score on TipRanks. These stocks have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Is BDX Stock a Buy?

BDX has a strong track record of financial stability, with 52 consecutive years of dividend increases. The company is well-positioned for growth, thanks to its strategic expansion through acquisitions, a strong pipeline, and its extensive global reach.

On TipRanks, Becton Dickinson has a Strong Buy consensus rating based on six Buy and two Hold recommendations assigned in the past three months. BDX stock’s 12-month average price target of $284.50 implies a 19.23% upside potential from current levels. Over the past three months, shares of the company have risen 2.5%.

Is Sysco a Good Stock to Buy Now?

Global food products giant Sysco has an impressive track record of increasing its dividend for 54 consecutive years. SYY’s efforts to expand supply chain capacity with new fulfillment centers, diversified product offerings, and strong momentum in the restaurant business are expected to keep supporting Sysco’s performance.

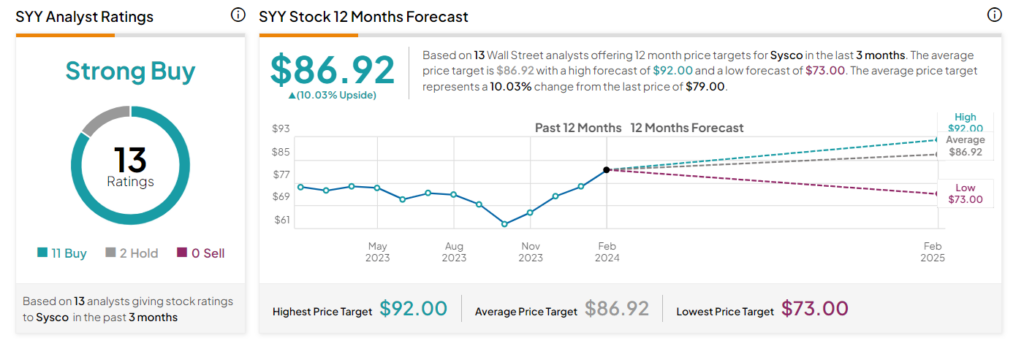

Overall, Wall Street analysts are highly optimistic about SYY stock. It has received 11 Buy and two Hold recommendations for a Strong Buy consensus rating. The average Sysco stock price target of $86.92 implies over 10% upside potential from current levels. Shares of the company have gained about 12% in the past three months. It carries a “Perfect 10” Smart Score.

Concluding Thoughts

GD, SYY, and BDX are three firms with strong dividend growth histories and robust business models. In addition, the potential for upside in the near term makes these companies attractive for investors seeking consistent dividend income.