Global energy major Exxon Mobil’s (NYSE:XOM) third-quarter numbers fell short of expectations on both the top-line and bottom-line fronts. However, cash flow generation remained healthy, and the company hiked its quarterly dividend by 4.4% to $0.95 per share.

During the quarter, revenue declined by 19% year-over-year to $90.76 billion, missing estimates by $1.8 billion. Similarly, EPS of $2.27 lagged expectations by $0.10. The company’s upstream earnings declined year-over-year by $6.3 billion to $6.12 billion due to lower natural gas and crude realizations. In Energy Products, earnings declined year-over-year by $3.4 billion to $2.4 billion amid weak refining margins and unfavorable foreign currency movement.

At the same time, Exxon achieved its highest-ever global refinery throughput of 4.2 million barrels a day and increased its cash balance by $3.4 billion on the back of $16 billion in operating cash flow.

The company expects capital and exploration expenditures for the full year to remain at the upper end of its outlook of $23 billion to $25 billion. Recently, Exxon also announced a $59.5 billion merger with Pioneer Natural Resources (NYSE:PXD). The transaction is expected to drive Exxon’s Permian production. Meanwhile, XOM’s quarterly dividend is payable on December 11 to investors of record on November 15.

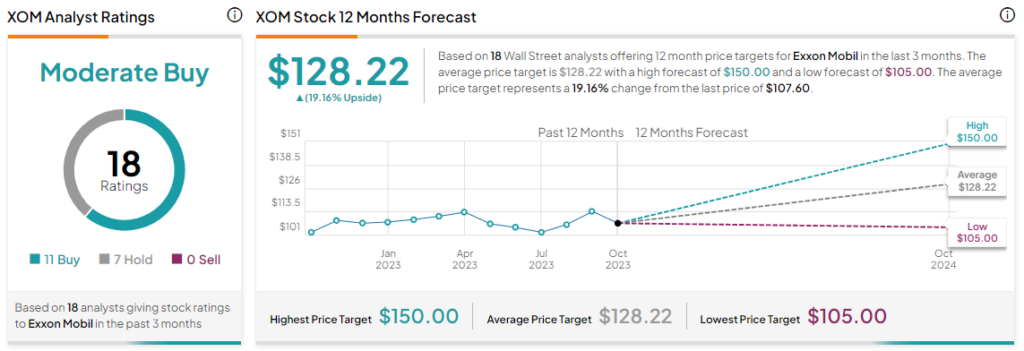

Is XOM a Buy, Sell, or a Hold?

Overall, the Street has a Moderate Buy consensus rating on Exxon. The average XOM price target of $128.22 implies a 19.2% potential upside.

Read full Disclosure