Domino’s Pizza stock (NYSE:DPZ) has recorded a notable rally from last year’s lows, with rising profits strengthening investors’ confidence in its future prospects. Boasting over 20,500 locations globally, the world’s largest pizza company has reignited Wall Street’s interest in its stock by posting record revenues and EPS in its most recent results. Further, management’s new Hungry for MORE strategy is poised to keep fueling sales and profits higher, forming a compelling investment case. Thus, I’m bullish on DPZ stock.

New Stores and Hungry for MORE Strategy Drive Record Revenues

Domino’s most recent quarterly earnings report highlighted another period of robust new store openings, which, along with the company’s Hungry for MORE strategy, drove record revenues.

Before I share the details of the Hungry for MORE strategy, I think it’s essential to grasp the underlying rationale of this initiative. That is, Domino’s is a very mature player in the QSR (quick-service restaurant) space with a massive global footprint, including 20,500 locations.

The company has persistently expanded its franchise network over the years. Last year was no different, with the company opening 711 net locations despite the closure of 159 stores in Russia.

However, at some point, the rate of new store openings will have to slow down. Domino’s already huge presence suggests a future limitation on this front. Management acknowledges the need to lay a solid foundation for sustained future growth, hence the birth of Domino’s Hungry for MORE strategy.

The MORE strategy aims to be implemented over the next five years. Of course, the goal is to increase sales, stores, and profits in a more sustainable manner. The MORE acronym can be broken down like this:

M: Most Delicious Food: The “M” in the MORE strategy focuses on promoting the company’s claim to have the most delicious food in the industry. This involves renewed advertising plans, with a new emphasis on Pan Pizza as a best-kept secret. In my view, this is Domino’s strongest catalyst in terms of driving strong same-store sales over time. The whole “secret sauce” concept is a massive advantage for companies in the space. Think of KFC as an example.

O: Operational Excellence: For “O,” the strategy centers on operational excellence to consistently deliver the most delicious food. Take the Summer of Service program Domino’s run in 2023, for example, which brought service times back to pre-COVID levels. For 2024, a new program, MORE Delicious Operations, has been introduced. This time, it focuses on three product training runs to improve consistency in food preparation through proper teaching, among other ways.

R: Renowned Value: The “R” emphasizes Domino’s position as a value player and involves promoting the loyalty program. Affordable prices, after all, make for a major reason people opt for fast food. The loyalty program can, therefore, benefit both consumers, who can enjoy lower prices, and Domino’s, which should enjoy more predictable cash flows.

E: Enhanced Best-in-Class Franchisees: Finally, the “E” letter highlights the importance of ensuring best-in-class franchisees. In 2023, for instance, the company added over 60 new franchisees in the 711 net openings I mentioned earlier. Many of these franchisees started their careers at Domino’s as delivery drivers or within the company. They’re people who know the business of operating a store inside out and are not just businessmen seeking to make a profit. This should ensure long-term success for the brand.

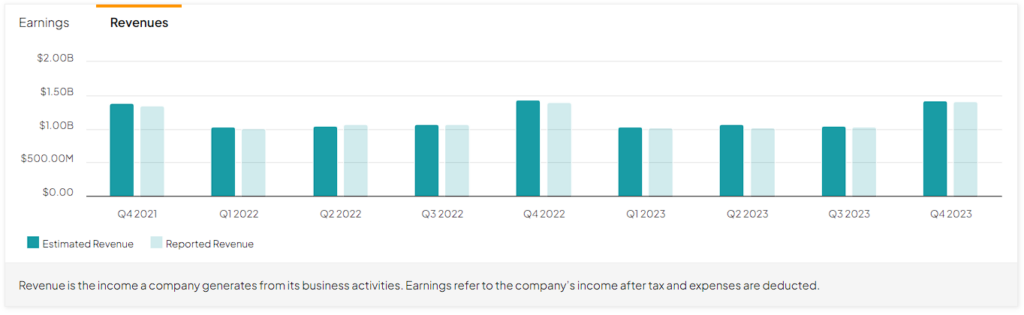

The implementation of the Hungry for MORE strategy helped drive a decent increase in same-store sales for Domino’s, this time by 5.9% and 2.6% for U.S. company-owned stores and franchised stores, respectively. Along with additional revenues through the additional store openings, Domino’s posted revenue growth of 0.8% to $1.40 billion — a new quarterly record.

Note that the only reason the 0.8% increase seems soft relative to same-store-sales growth new openings is lower Ad revenues — a cyclical component of the revenue mix that shouldn’t be cause for concern, in my view.

Record EPS Drives Optimism, Boosts Earnings Growth Outlook

Domino’s strong sales, margin expansion, and share buybacks over the past four quarters resulted in growing EPS, which landed at $4.48 for the quarter and $14.66 for the year — both record figures. The $14.66 figure actually implies a significant increase of 17%, driving investor optimism and boosting Wall Street’s growth outlook for Domino’s.

Specifically, consensus estimates from analysts forecast that EPS will grow by a compound annual growth rate of 12.34% through 2029. Given how mature Domino’s is at this point, the prospect of lasting double-digit EPS growth over the medium term highlights the quality of the business and the confidence the market has in management’s five-year Hungry for MORE strategy.

Further, I believe that this EPS growth outlook justifies Domino’s forward P/E of 28.2x. This may not seem like a cheap multiple. However, given Domino’s moat, high-margin royalty-based business model, and double-digit EPS growth outlook, a modest premium is well-deserved.

Is DPZ Stock a Buy, According to Analysts?

Checking Wall Street’s sentiment on the stock, Domino’s Pizza features a Moderate Buy consensus rating based on 15 Buys, 10 Holds, and one Sell assigned in the past three months. At $482.40, the average Domino’s Pizza stock price target implies 7.84% upside potential.

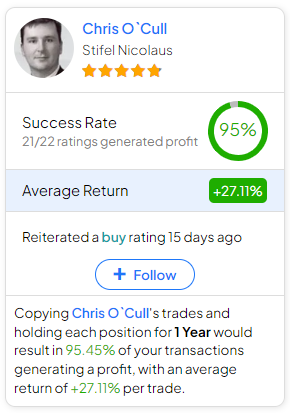

If you’re unsure which analyst you should follow if you want to trade DPZ stock, the most profitable analyst covering the stock (on a one-year timeframe) is Chris O’Cull from Stifel Nicolaus. He boasts an average return of 27.11% per rating and a 95% success rate. Click on the image below to learn more.

The Takeaway

Overall, I think Domino’s Pizza presents a compelling investment case. The company achieved record revenues and EPS in its most recent quarterly report—a trend poised to persist as the new Hungry for MORE strategy is implemented.

Despite the stock’s rally from last year’s low and its seemingly above-average valuation, I believe that Domino’s strong medium-term growth outlook should sustain its bullish momentum.