When Nvidia (NASDAQ:NVDA) released its first 13F filing on February 14, disclosing investment in other companies, it unleashed a firestorm. Shares of companies listed in the report have seen tremendous appreciation, including SoundHound AI (NASDAQ:SOUN), which has rallied by an astonishing 259%. Wall Street analysts’ ratings indicate their optimism about the stock despite its rich valuation, reflecting confidence in SOUN’s AI capabilities.

Investors frequently look for companies where the market is missing the story or not fully valuing it appropriately. They do so with the idea that a catalyst event will come along and make market participants revisit it, realize the error of their ways, and reward the company (and thus the investor) with a healthier valuation.Was Nvidia’s filing such a catalyst? Or did it elevate new AI-themed targets for investors already engaged in animal spirits? In SoundHounds’ case, I suspect it’s a mix of both.

Aside from SoundHound, shares of ARM Holdings (NASDAQ:ARM) have jumped over 90%, Nano X Imaging (NASDAQ:NNOX) is up over 70%, and TuSimple Holdings (OTCMKTS:TSPH) shares have risen over 80% since Nvidia’s 13F filing mentioned them.

The Case for SoundHound

SoundHound AI develops and commercializes voice, sound, and natural language artificial intelligence (AI) technologies and related activities. Notably, 90% of the company’s current revenue comes from royalty payments for each unit of technology using its voice AI capabilities, with the remainder coming from subscription fees paid by businesses for access to those voice AI capabilities.

The company is currently working on integrating the NVIDIA DRIVE platform with an in-vehicle voice assistant. The technology will provide drivers access to SoundHound Vehicle Intelligence, a product that instantly delivers information using natural speech, ranging from parsing the car manual to answering vehicle maintenance questions to pre-ordering food for pick-up.

The company estimates the total addressable market for these services will be over $160 billion in 2026, and management expects each of the “three pillars” (royalties, subscription, and monetization) to grow into more than $1 billion businesses.

Financial Results and Outlook

So far, SoundHound’s results have been encouraging. The company’s revenue for the fourth quarter of 2023 increased by 80% year-over-year to $17.1 million, and the full-year revenue surged by 47% YoY to $45.9 million. Though the company reported a net loss of $0.07 for the quarter and $0.40 for the full year, there was a significant improvement compared to the previous year (53% and 46%, respectively).

Further, the company expects full-year 2024 revenue to be between $63 and $77 million, with a midpoint target of $70 million. Management has also introduced a 2025 outlook, in which it expects growth to accelerate, with revenue exceeding $100 million, achieving positive adjusted EBITDA.

What is the Price Forecast for SOUN?

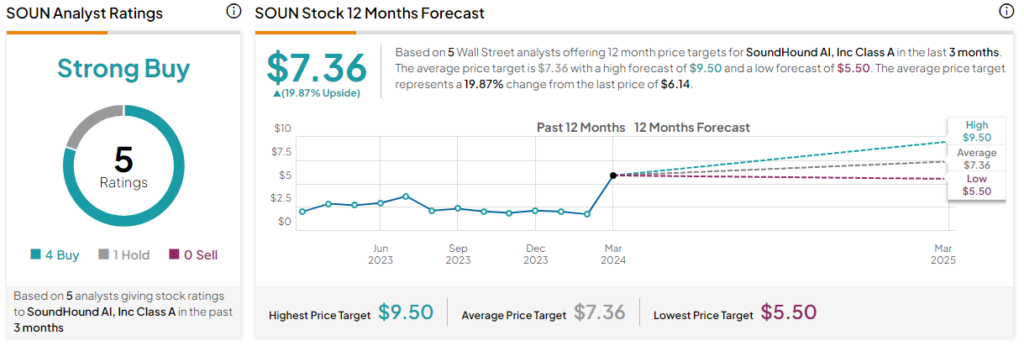

SOUN stock is currently rated a Strong Buy based on four Buys versus One Hold rating. The average price target for SOUN stock is $7.36, which represents a 19.87% upside from current levels.

At $6.14, the stock is currently trading at the mid-point of its 52-week range of $1.49-$10.25. It has pulled back a bit in the past few days, demonstrating mixed technical indicators, suggesting more short-term volatility is likely.

However, the recent price run-up has pushed the stock to a relatively significant premium valuation. SOUN’s P/S (price-to-sale) ratio of 30.67x dwarfs the Technology sector and the Software-Application industry averages (4.7x and 7.17x, respectively) and its own historical average of 14.5x.

Final Thoughts on SoundHound

SoundHound is in a position to grow with the exploding technological innovations spawned by AI. The company has a 25% market share in its largest current vertical, and promising developments are in the pipeline.

However, based on the fundamentals, investors are paying a rich premium for the privilege of participating in the AI bubble. Enthusiasm can certainly continue to drive the stock to higher levels from here, but as we have seen in the past, when the bubble bursts, the air can go rushing out quickly, taking valuations down with it.

The current price may not matter much for long-term tech-oriented investors who love the story and can ride out the inevitable volatility. As an admittedly value-oriented investor, I’ll look for an opportunity to buy it on the dip.