U.S. semiconductor and infrastructure software solutions provider Broadcom (NASDAQ:AVGO) and multi-cloud services company VMware (NYSE:VMW) expect their business combination to close “soon,” prior to the expiry of the merger agreement between the two companies. The deal was originally slated to close today but approval from China is yet to materialize.

The approval delay from China comes amid rising tensions between the U.S. and China. Meanwhile, Hock Tan, the CEO of Broadcom, opined that the delay in the closing of the transaction is not political but due to bureaucratic snags, according to CNBC.

The $69 billion transaction has so far received legal merger green light in Australia, Canada, Europe, Israel, Japan, South Korea, South Africa, Taiwan, and the U.K. Additionally, the transaction faces no legal hurdle in the U.S.

Further, VMware shareholders are entitled to receive $142.50 in cash and 0.2520 of a Broadcom share for each VMware share held by them. Following a shareholder vote, in which about 96% of VMW investors of record elected to receive stock consideration, nearly 52.1% of such shares will be converted into the right to receive 0.2520 AVGO shares and nearly 47.9% of such shares will be converted into the right to receive $142.50 in cash for each VMW share.

What Is the Price Target for AVGO?

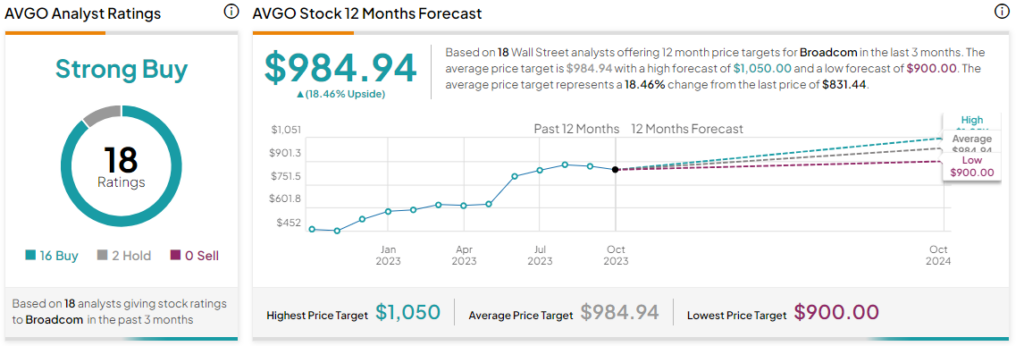

Overall, the Street has a Strong Buy consensus rating on Broadcom. The average AVGO price target of $984.94 implies an 18.6% potential upside. That’s on top of a nearly 77% rally in the share price over the past year.

Read full Disclosure