The Federal Aviation Administration (FAA) launched a new probe into Boeing (NYSE:BA), the Wall Street Journal reported. This investigation stems from Boeing’s voluntary disclosure to the regulatory agency regarding possible lapses in inspections and falsification of documentation by certain employees concerning 787 Dreamliners.

Boeing, a leading manufacturer of commercial airplanes, defense products, and space systems, faces mounting quality concerns.

Boeing’s Growing Quality Concerns

According to the report, Boeing informed the FAA in April that it may have missed mandated inspections on specific Dreamliners. These inspections relate to bonding and grounding procedures aimed at reducing electrical risks near the aircraft’s fuel tanks.

The FAA is currently scrutinizing whether Boeing executed the necessary inspections and if there were instances of falsified aircraft records by its employees. This comes amid the FAA’s increased supervision of Boeing’s production after an event on an Alaska Airlines (NYSE:ALK) flight where a part of the plane detached mid-air. Consequently, Boeing compensated Alaska Air significantly.

BA’s Risk Analysis

As Boeing faces production and quality issues, TipRanks’ Risk Analysis tool shows its production risk exposure is higher than the industry average. Production risk accounts for 26.9% of its total risks, higher than the industry average of 18.5%.

The tool also highlights that its “legal and regulatory,” as well as its “ability to sell” risks, surpass the sector average.

Is Boeing Stock a Buy, Sell, or Hold?

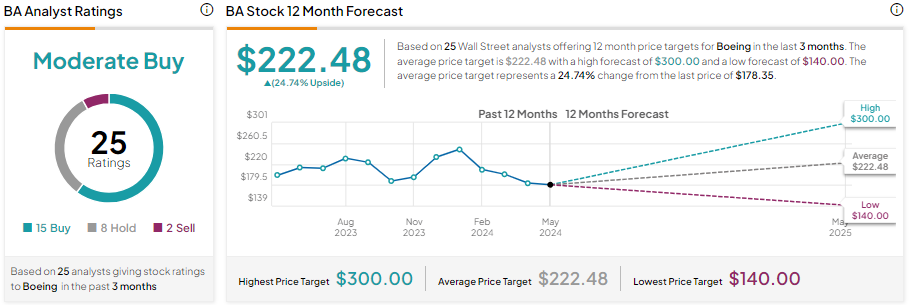

Boeing stock is down about 31.5% year-to-date, reflecting the ongoing quality concerns. It has 15 Buys, eight Holds, and two Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target on BA stock is $222.48, implying 24.74% upside potential from current levels.