Bitcoin (BTC-USD) miner CleanSpark’s (NASDAQ:CLSK) shares took a nosedive, plummeting 10% in after-hours trading yesterday after the company announced an expanded $800 million stock offering. The offering is significantly higher than the previously agreed $500 million deal with H.C. Wainwright & Co.

CleanSpark Decision Hits Other Miners

Initially, CleanSpark’s $500 million at-the-market (ATM) offering seemed like a calculated move to bolster its position within the competitive mining landscape. However, the upsized $800 million offering has stirred concerns over share dilution, with a projected 19% dilution rate based on the company’s $4.2 billion market cap.

While common among public companies seeking capital influx, this strategy has notably rattled investor confidence.

This event has impacted CleanSpark and cast a shadow over the broader Bitcoin mining sector, prompting comparisons with similar ATM agreements by rivals Riot Platforms (NASDAQ:RIOT) and Marathon Digital Holdings (NASDAQ:MARA).

Despite the short-term downside in price action, Bitcoin’s halving event may be a boon for CleanSpark. CLSK boasts a competitive edge with the lowest production cost per Bitcoin while doubling its hash rate with recent acquisitions.

Levels to Watch This Weekend

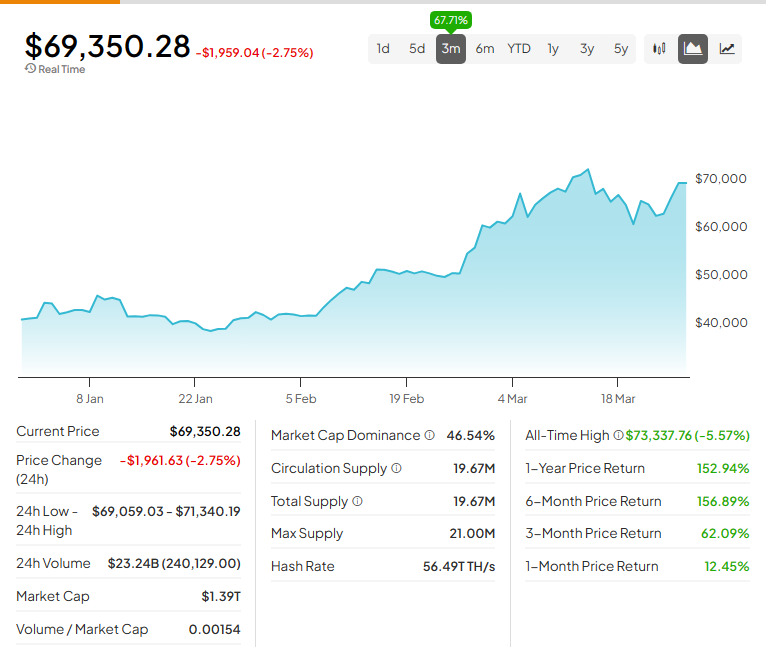

From a technical analysis perspective, Bitcoin remains exceptionally bullish on a long-term timeframe. However, there are some concerns that its performance may turn bearish in the near term.

Since hitting a new all-time high of $73,734 on March 14, Bitcoin’s price action has been mixed. Between March 14 and March 21, BTC dove -17.5% to the $60,700 value area (a drop of -$13,000). Since then, bulls have spent the last nine days grinding higher back to the $70,000 value area, but the bulls have been either unwilling or unable to move higher. Near-term resistance is at the $71,450 level, while support sits at $60,750.

Don’t let crypto give you a run for your money. Track coin prices here