AstraZeneca (NASDAQ:AZN) shares are ticking higher in the pre-market session today after the global biopharmaceutical behemoth delivered a better-than-anticipated bottom line for the third quarter and raised its outlook for the full year. EPS of $1.73 outperformed expectations by $0.89. Revenue of $11.49 billion, on the other hand, missed estimates by $60 million despite clocking a 4.6% year-over-year increase.

During the quarter, AstraZeneca’s non-COVID-19 portfolio experienced a 13% gain, with double-digit growth in its Oncology, CVRM (Cardiovascular, Renal and Metabolism), and Rare disease products. In Oncology, robust sales of Farxiga, Lokelma, and Roxadustat more than offset a single-digit decline in Brilinta. Growth in Rare diseases was led by higher sales of Ultomiris, Strensiq, and Koselugo.

Excluding COVID-19 products, the company experienced a 12% growth in the U.S. and a 23% growth in Europe. Buoyed by this business momentum, AstraZeneca now expects total revenue for Fiscal year 2023 to increase by a mid-single-digit percentage, compared to the prior expectation of a low-to-mid-single-digit growth.

Core EPS for the year is expected to increase by a low double-digit to low-teens percentage. Previously, the company had anticipated growth of high single-digits to low double-digits in its core EPS. Additionally, AstraZeneca’s $2 billion licensing deal for Eccogene’s investigational candidate ECC5004 could potentially boost the company’s CVRM portfolio. ECC5004 is targeted for the treatment of type-2 diabetes, obesity, and other cardiometabolic conditions.

What Is the Target Price for AZN Share?

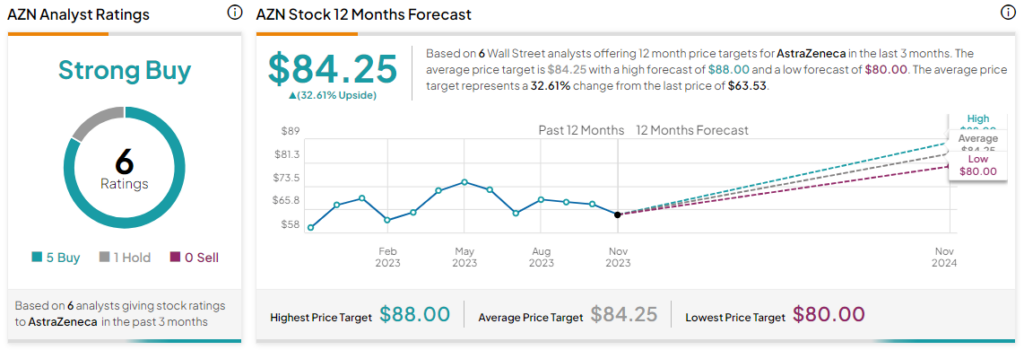

Overall, the Street has a Strong Buy consensus rating on AstraZeneca. Following a nearly 16% slide in the company’s shares over the past six months, the average AZN price target of $84.25 implies a substantial 32.6% potential upside.

Read full Disclosure