So far this year, the stock markets are riding high, with both the S&P 500 and the NASDAQ standing just under their record levels. However, the picture may not be all roses and light.

Covering the markets from B. Riley Wealth Management, chief investment strategist Paul Dietrich is predicting a mild recession in the US this year – but also an S&P decline of up to 44%. Dietrich is noted for advising his clients to move out of stocks ahead of recessions and market downturns in 2000 and 2007.

Summing up his attitude toward current conditions, Dietrich said, “Despite the fun and excitement of participation in the current Mardi Gras-like stock market bubble completely untethered to any stock fundamentals, suppose an investor could miss most of a 49% or 57% decline in the S&P 500 index and then get back into the stock market when the leading economic indicators and long-term moving averages indicate the recession is over.”

This is a recipe for a defensive portfolio stance, and some of Wall Street’s analysts are recommending dividend stocks as solid buys right now. Div stocks are the classic defensive play in a tough investing environment – and for investors looking to realize up to 13% returns on dividend yields, the analysts are suggesting 2 dividend stocks in particular. Let’s take a closer look.

Annaly Capital Management (NLY)

We’ll start with Annaly Capital Management, a real estate investment trust, or REIT, that focuses its business on residential real estate and mortgage-backed securities. The company is a leader in the mREIT segment, with a market cap of $9.45 billion and approximately $11 billion in permanent capital. Annaly boasts an investment portfolio totaling $73.5 billion, and of that total, some $64.7 billion is held in the company’s ‘highly liquid’ Agency portfolio segment.

In addition to its sizable Agency portfolio, Annaly also has large investments in residential credit and mortgage servicing rights. The larger of these two segments is the Residential Credit portfolio, valued at $6.2 billion, while the Mortgage Servicing Rights portfolio holds $2.7 billion worth of assets. These portfolio valuations are current as of the company’s March 31 financial report for 1Q24.

Also in the recent Q1 financial release, Annaly reported a GAAP net income figure of 85 cents per share. The non-GAAP figure, of earnings available for distribution, was 64 cents per share, down a penny year-over-year. The company generated an economic return of 4.8% in the first quarter and finished the quarter with a book value of $19.73 per share, above the $19.44 value reported for the previous quarter.

Turning to the dividend, we find that Annaly declared a regular payment of 65 cents per common share on March 14, for a payout today (April 30). This will mark the fifth quarter in a row with the dividend at this level, which annualizes to $2.60 per common share and gives a forward yield of nearly 13.6%, far above the current rate of inflation.

Covering Annaly for Compass Point, analyst Merrill Ross takes a deep dive into the company’s portfolio performance in Q1, noting, “The driving force behind the improvement in the yield on the investment portfolio (from 4.55% in 4Q23 to 4.88% in 1Q24) was investing low-yielding runoff in the current 6.25% coupon. The NIM contracted in 1Q24 from 158 bps to 143 bps, but we expect it to widen from here as investing in current coupon assets outweighs the increase in swap-adjusted funding costs as rates remain higher for longer. Unlike its peers, NLY is allocating capital on the margin more heavily to residential credit and low-coupon MSR, but has no fear of missing out on the positive impact on BVPS (book value per share) that would come from continued spread tightening in agency MBS, which accounted for 58% of its equity allocation at period end.”

Getting to her conclusion, Ross goes on to say, “We adjusted the quarterly progression to a more moderate pace for the rest of the year, and have removed any Fed easing from our model. Barring unanticipated exogenous events that could cause volatility, we think NLY will post positive total returns for the next three quarters, creating value through steady dividends and modest increases in BVPS.”

Ross quantifies her stance with a Buy rating on the shares, with a $22 price target that implies a 15% upside for the coming year. Added to the dividend yield, the total return on this stock may reach over 28% in the next 12 months. (To watch Ross’s track record, click here)

Overall, Annaly gets a Moderate Buy rating from the analyst consensus, based on 7 recent reviews that include 5 Buys and 2 Holds. The shares are trading for $19.09 and the $20.57 average target price suggests the stock has a one-year upside potential of 8%. (See NLY stock forecast)

Delek Logistics (DKL)

From a REIT, we’ll shift our gaze to the energy sector where Delek Logistics owns, acquires, builds, and operates a wide range of assets for the storage, transport, distribution, and marketing of crude oil and refined products. The company operates in the Southern US, and its asset map stretches across Texas and Louisiana and into Oklahoma, Arkansas, and Tennessee.

On the hydrocarbon side of the operations, Delek’s refining operation controls 4 inland refineries located in Texas, Louisiana, and Arkansas, capable of maintaining 302,000 barrels per day in throughput. The company’s logistic system handles the storage, transport, and distribution activities. Additionally, Delek is well-known as a provider of asphalt technologies and materials, produced at 7 facilities in the company’s network.

Delek’s hydrocarbon activities make up the bulk of the company’s operations, but it is also deeply involved in the production of renewable biodiesel fuel. Delek has three biodiesel plants in operation, with a productive capacity of approximately 40 million gallons annually.

The last public quarterly financial report from Delek was released in February and covered 4Q23. In that quarter, Delek brought in a total of $254.15 million in net revenues, missing the forecast by $24.1 million and dropping 5.5% year-over-year. At the bottom line, the company realized a net income of $22.1 million, translating to 51 cents per diluted common share. The prior-year figure was 98 cents per share, and the analyst expectation was 85 cents; the wide miss in bottom-line earnings was attributed to higher interest expenses and a goodwill impairment recorded in the quarter. In another interesting metric, the company generated a quarterly free cash flow of $64.57 million, up more than 25% year-over-year.

On the dividend front, Delek declared on April 25 a common share payment of $1.07 for 1Q24. This represents an increase of 4.4% year-over-year, and the $4.28 annualized payment gives a yield of 10.8%. The dividend will be paid out on May 15.

This stock has caught the attention of Neal Dingmann, a 5-star analyst and energy industry expert from Truist Securities. Dingmann sees plenty of reason for investor optimism regarding Delek, specifically the company’s estimated forward free cash flow and dividend yields, writing, “We believe Delek Logistics Partners units have material upside driven by a combination of stable high margin affiliate business coupled with growing third-party activity with improving margins. We forecast the partnership to generate significant, incremental FCF from the strategic business combination. We estimate a 2025 FCF yield of ~8% and distribution yield of ~12%. Our PT is based upon an EV/’25EBITDA multiple of ~9.0x; all among the best of its peer group… Further, we believe an upcoming indices rebalance could provide additional unit price upside.”

These comments back up Dingmann’s Buy rating on DKL, while his $46 price target indicates room for a 16% one-year upside. Together with the high dividend yield, this stock is on track to return almost 27% on the one-year horizon. (To watch Dingmann’s track record, click here)

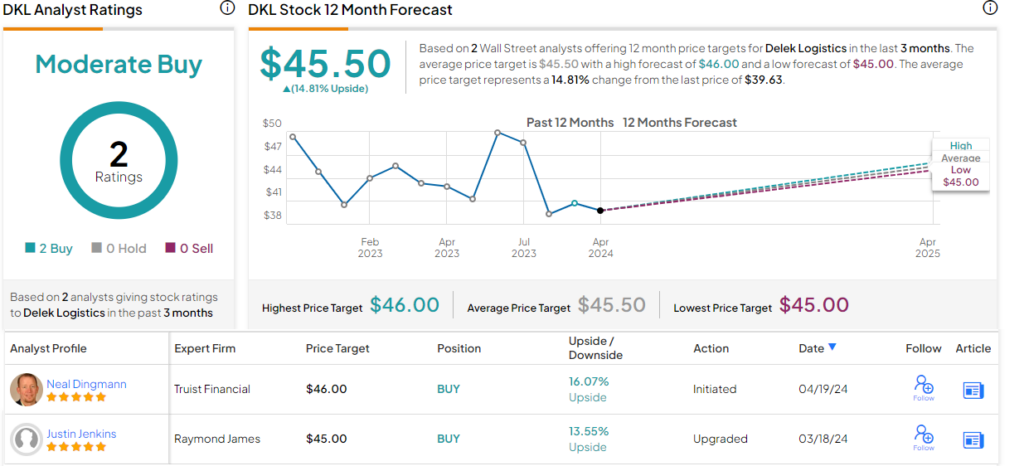

Delek shares have only 2 recent analyst reviews, but they are both positive, giving the stock its Moderate Buy consensus rating. The shares are selling for $39.63, and the average target price, $45.50, implies they will gain 15% in the year ahead. (See DKL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.