AppLovin’s (NASDAQ:APP) success may have gone under the radar somewhat over the past year. The company, which specializes in optimizing marketing revenues for app developers and operators, has delivered impressive revenue and earnings growth and has seen its share price surge 413% over the past 12 months, outpacing all of the Magnificent Seven stocks. Despite the share price surge, AppLovin still presents good value with an attractive PEG ratio and plenty more signs that the stock could go higher.

Building with AI

AppLovin specializes in creating software that aids mobile application developers and operators in boosting their business revenue. The firm’s objective is to improve the marketing and take rate of applications, allowing businesses to enhance app monetization. AppLovin offers a suite of tools, including MAX, AppDiscovery, and SparkLabs, which handle marketing, advert placement, data analysis, and even publishing for app creators.

The Palo Alto firm also runs Lion Studios (which promotes and publishes mobile games) and invests in other game publishers. The segment helps developers of all sizes build mobile games, some of which have been chart toppers, including Mr Bullet, Ink Inc, and Pull Him Out. As such, AppLovin has become something of a one-stop shop for companies looking to develop and monetize mobile applications.

Moreover, AppLovin is making use of developments in AI and recently released AXON 2.0 — its newest technology. AppLovin’s AI-based advertising engine boosts revenues by recommending apps that users will like based on their preferences and previous activity, increasing advertiser performance and generating improved payouts.

Essentially, AppLovin helps developers find users, make money through ads and in-app purchases, and improve their apps. AI looks like it will profoundly impact the company’s ability to generate returns for its customers. This is particularly important when AppLovin’s target market spends according to campaign performance rather than having fixed budgets.

Is AI Working?

AppLovin hasn’t provided much information about AXON 2.0 and how it’s different from the original AXON. CEO Adam Foroughi simply said, “It’s better.” However, so far, the software seems to be working, with AppLovin’s software platform revenue up 88% year-on-year in the fourth quarter. The business segment also achieved a highly impressive 73% adjusted EBITDA margin.

Moreover, AppLovin hasn’t provided explicit guidance beyond the current quarter, noting that the true impact of AXON 2.0 isn’t fully clear. In short, because the use of AI is so novel in this space, the company hasn’t managed to fully assess the value of the opportunity. Many of the analysts simply took a punt on forward revenues, and, as such, it’s all eyes on earnings from here.

However, it’s worth recognizing that AppLovin’s growth rates have been rather erratic historically. In Q4 2022 and Q2 2023, revenue growth actually reversed sequentially. This will undoubtedly have an impact on how much investors are willing to pay for the stock and likely contributes to the company’s current favorable valuation.

The last couple of quarters, however, have been different. The business has beaten expectations and raised guidance every time. In Q3 2023, forecasts were for $780-800 million in revenue, and the company delivered $864 million. For Q4 2023, estimates were for $910-930 million in revenue, and AppLovin delivered $953 million. Moving forward to Q1 2024, the consensus estimate points towards $966.6 million in revenue.

Enticing Valuation

The digital advertising space is worth a huge $667 billion. Although Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta (NASDAQ:META) have commanding shares in the sector — $283 billion and $117 billion, respectively — AppLovin is fighting for a share of the remaining, and still sizeable, $267 billion landscape. It’s a strong sector — one that is only likely to grow with digital trends.

Analysts forecast AppLovin’s earnings to grow by 20% annually over the next three to five years. That’s strong growth throughout the medium term. While I appreciate that forecasting earnings growth is challenging, given the introduction of AXON 2.0, the consensus is very positive. In turn, given AppLovin’s forward price-to-earnings ratio of 15.9x, the company’s all-important price-to-earnings-to-growth ratio is 0.69.

A ratio of one suggests that a stock is trading at fair value, and a ratio of 0.79 infers that AppLovin’s growth potential is significantly underappreciated. AppLovin does hold a fair amount of debt — $3.94 billion. However, this debt position is looking less concerning, given the exponential growth in the company’s value.

Is AppLovin Stock a Buy, According to Analysts?

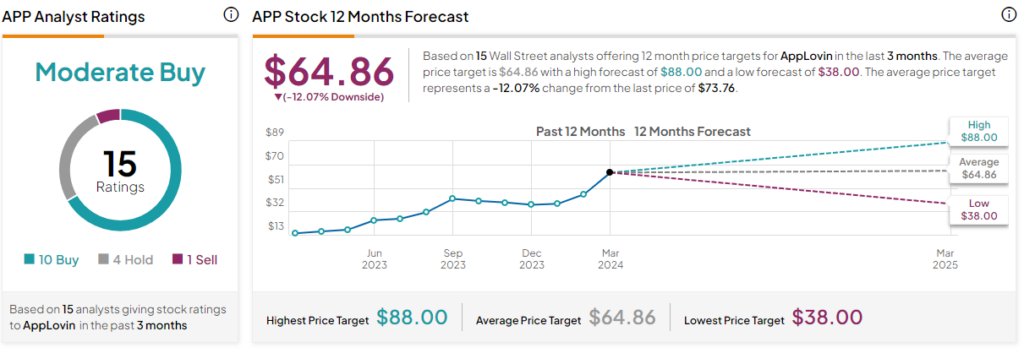

According to analysts, AppLovin stock is considered a Moderate Buy. There are 10 Buy ratings, four Holds, and one Sell. The average AppLovin stock price target is $64.86, inferring 12.1% downside from the current share price. The highest share price target is $88, and the lowest share price target is $38. It appears that share price forecasts haven’t kept up with the company’s significant share price growth in recent quarters.

The Bottom Line

With AI seemingly providing a step change in AppLovin’s capacity to deliver results for shareholders, there’s cause to be optimistic, going forward. AppLovin looks set to grow revenue and earnings substantially over the medium term, and despite the share price surging over the past 12 months, this growth remains underappreciated. The signs suggest it could continue to outperform the market.